ECB Preview: A Final Rate Hike, But Restrictive Policies Are Not Over

- We expect the ECB to deliver a final 25bp rate hike during next week’s ECB meeting due to still too strong inflation momentum and projected inflation above the target. We also expect an advancement of the end to full reinvestment process of PEPP currently guided for Dec 24 to be on the cards. Specifically, we expect ECB to ‘task committees’ for an announcement at the October meeting.

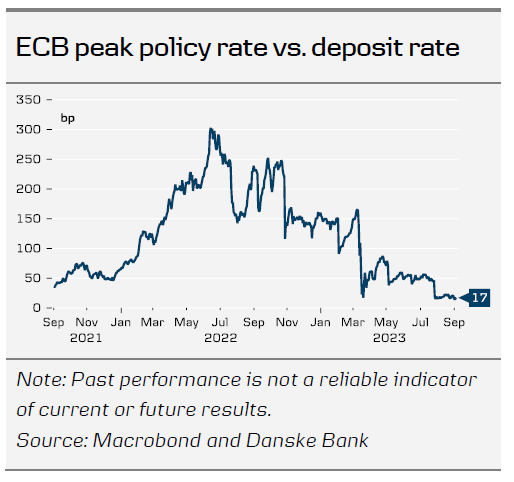

- The economic outlook has worsened since the July meeting, but the momentum in inflation is yet to show convincing dynamics, and given ECB’s sole inflation mandate, we expect this inflation momentum to prevail. Currently, markets have put significant focus on the disinflationary impulse underway and the weaker growth outlook and therefore markets are only pricing 8bp of rate hikes for next week and 17bp of additional hikes altogether. A compromise in the governing council could be no hike and an acceleration of the balance sheet normalisation, but given the policy rate is the primary tool to calibrate its monetary policy stance, we expect a rate hike.

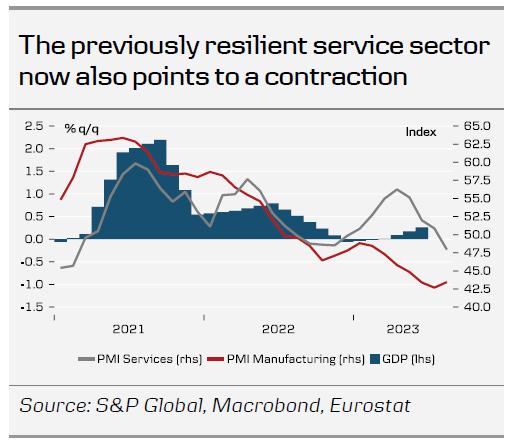

The service sector is now also in contraction

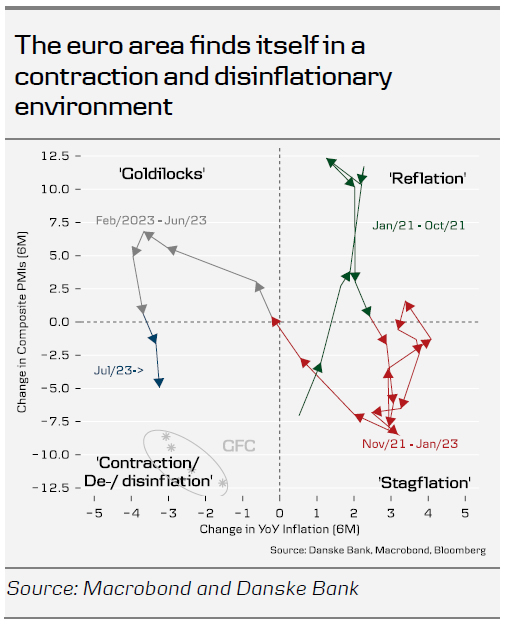

The euro area economy has fared better than expected this year, despite the previous energy crisis and inflation shock. Since the ECB meeting in July, the resilient service sector that kept the euro area activity buoyant, has shown signs of weakness with a below 50 PMI print in August. The PMIs showed that the ongoing demand conditions continued to worsen in August as new orders continued to decline. External demand is deteriorating due to challenges in the Chinese economy, while internal demand is yet to see the full impact of the ECB’s monetary tightening. Consequently, we expect a lingering weakness in the euro area activity and specifically we expect a contraction in the euro area GDP in the second half of 2023 and foresee no meaningful rebound before next summer.

Sticky core inflation is a key upside risk to the inflation outlook

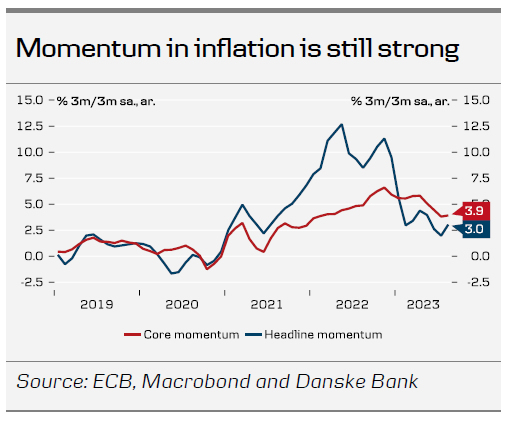

While the inflationary pressure has decreased sharply since last year, based on reviewing the headline figures, the underlying measures of inflation have shown a high degree of stickiness, which has consequently kept the ECB in a tightening mode. The drivers of inflation have shifted from external sources to internal pressures driven by increased wages and strong profit margins, a point that Lagarde also made recently. Wage pressures have been high, thanks to the remarkably strong labour market, despite significant monetary policy tightening. The July minutes referred to the 3m on 3m annualised headline inflation was ‘about 2%’ in June. Since then, that has picked up to 3% in August.

The strong labour market and large wage increases are keeping the pressure on core inflation which presents a challenge for the ECB. The momentum in core inflation is still high at 3.9% 3m/3m SAAR. The stickiness of core inflation is a key upside risk to the inflation outlook. On the positive side, service price inflation has ticked down in annual terms since the last ECB meeting, but it is still printing at 5.5%. The most recent business surveys show that the service sector is still increasing prices, although at a slower pace than previously.

New staff projections will be closely watched

We will closely watch the ECB staff projections on the back of recent developments. Oil prices have ticked up since the last projection at the June meeting, and futures point to an upward revision of the technical assumptions on oil prices in both 2023 and 2024. On the other hand, natural gas futures are broadly in line with the expectations used in June. Both headline and core inflation have printed well above what the June projection exercise suggested. Headline has so far averaged 5.3% for the first two months of Q3 which is 0.6pp higher than the June exercise suggested. Similar comparison for core was 0.2pp higher at 5.4% so far in Q3. As a result the 2023 outlook may revised slightly higher. For policy guidance, we put more emphasis on the 2024 and 2025 outlook, where a strong labour market and real wage increases will support inflation across the region. However, the recent weakening of the service sector could lower the price pressure. In 2024, the ECB’s latest projection of 3.0% y/y is slightly above the consensus of 2.6%. For 2025, inflation projections in June was 2.2% above the ECB’s target.

Wage indicators have risen markedly as compensation per employee rose 5.2% in Q1, while negotiated wages rose 4.3% in Q2. Tomorrow, we get Q2 compensation per employee data, which is the last important data release before the meeting.

No hike in September will likely mean end of rate hike cycle.

Markets are currently pricing 8bp of rate hikes in for next week’s meeting and 17bp to the peak rate. We only attach a slim probability of ECB skipping this meeting on a rate hike and then deliver one in October. Between the September and October meeting, the key new information we receive will be one inflation release, two PMI reports, a new bank lending survey and the SPF. Between the October meeting and December, we will receive plentiful of data including new staff projections, but for ECB to restart its hiking cycle in December after pausing for two meetings would require the euro area activity finds a new growth engine or we see a significant spike in inflation in our view. As a result, should ECB decide not to hike next week, we believe this is the end additional rate hikes. On the other hand, in our expectation of ECB hike next week, we expect ECB to keep an open door for further hikes, should it be needed – and this much relates to the inflation momentum.

ECB to pushback against expected easing of financial conditions

Shorter dated real forward rates in the euro area have shifted lower after the July meeting, implying an easing of the monetary policy stance. As Isabel Schnabel pointed out last week, markets are now pricing the real rates back to the levels we also observed at the February meeting, which are some c.20bp lower than at the July meeting. With the curve inversion in particular in the 2024 segment, we expect ECB to push back against an expectation of an imminent rate cut process and say it is premature to discuss rate cuts. ECB has put focus on the demand led inflation surge and hence to get inflation in line with the target, a sufficient restrictive monetary policy is required. We find the 2024 pricing of -70bp broadly fair. In our baseline scenario of ECB cutting 75bp next, we also highlight that risks are skewed to the topside on this.

Furthermore, a push back from ECB on the expected easing of financial conditions should also be seen in light of the expected inflation risk assessment being skewed to the upside. We find it challenging that ECB can pause at the current meeting with projected inflation in 2025 still above the 2% inflation target and a skewed inflation risk picture.

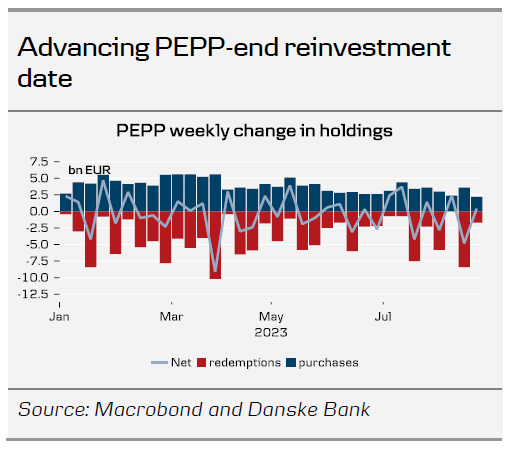

Advancing the end date of full PEPP reinvestments.

As we discussed in Reading the Markets EUR: Advancing the end to full PEPP reinvestments, 1 September, we expect the ECB to task committees to look into an advancement of the end to full PEPP reinvestments for a potential decision at the October meeting. We expect intentional vague language / guidance on ending PEPP reinvestments, which means that the ECB will have the flexibility to restart (even temporarily) reinvestments if it sees the need or if unfavourable market conditions persist, to continue its balance sheet normalisation. We expect an end to PEPP reinvestments to start from December this year. PEPP reinvestments averages EUR18bn/month currently.

Technical questions during the Q&A session

At the July meeting, ECB surprisingly announced a change the remuneration rate of the minimum reserve holdings starting on 20 September to be 0% (previously deposit rate). The upcoming change have been absorbed well by markets as anticipated, given that the MRR funds are ‘locked’ money and can’t be used for investable means. We do not expect this to feature in the Q&A session.

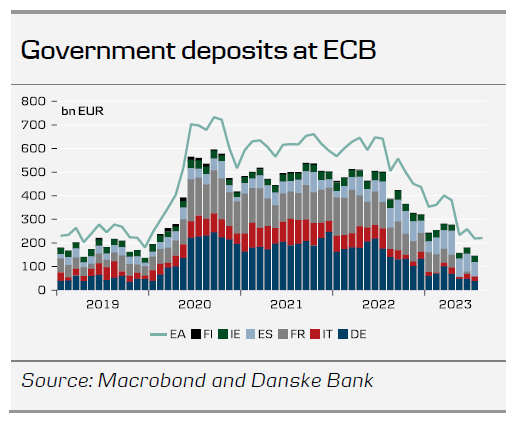

After the Bundesbank’s (BuBa) unilaterally changed the rate on the government deposits from 1 October we expect Lagarde to get questions of whether a common decision will follow the BuBa change will be coming up. As of 1 October, the BuBa will no longer pay €STR-20bp but 0% on government deposits and the change was made possible effective from May where the ECB allowed the NCBs to decide the interest rate on the deposits concerned. We highlight that Spain (around EUR62bn) and Ireland (around EUR26bn) still have significant government deposits. Italy has ‘only’ EUR19bn.

A hike will likely broadly boost the EUR

Given the market pricing, a 25bp rate hike from the ECB will likely prompt a knee-jerk reaction higher in EUR/USD by 1-2 figures almost regardless of the rhetoric on the press conference and the sequential growth outlook priced by markets.

Since mid-July, EUR/USD has been on a downward trajectory breaking below 1.0750. Generally, the theme of US outperformance has been dominating despite the US jobs report showing a more balanced labour market and wage growth cooling. In addition, weak growth prospects overseas, especially in the euro area and China have likely also been beneficial for the greenback in tandem with the domestic strength in the US economy leading to upward pressure on US yields, lately driven by improving signs in the manufacturing sector (although the sector is still in contractionary territory). The DXY USD index recently hit the highest level since March this year.

Going forward, we remain bearish on EUR/USD, although relative rates could boost the cross in the near-term if the ECB hikes. The growth outlook looks rather bleak in the euro area, and we are likely yet to see the full effect of ECB’s monetary policy tightening. On the other hand, the resilience of the US economy looks to be broadly continuing. Even though growth and inflation are declining in both regions, especially the former seems to be fading faster in the euro area. With central banks nearing peak policy rates, growth differentials increasingly appear to drive the cross. Hence, we maintain our strategic case for a lower EUR/USD, as we deem the US economy will remain on a relative stronger footing. We continue to forecast the cross at 1.06/.1.03 in 6/12M.