Friday November 3: Five things the markets are talking about

The October U.S jobs report is set for release at 08:30 am EDT and after the September headline print revealing the first monthly drop in seven-years – attributed to a hurricane effect – investor expectations for last month’s reading are considered very high.

Market consensus is looking for a headline print of +310k and an unemployment rate unchanged at +4.2%.

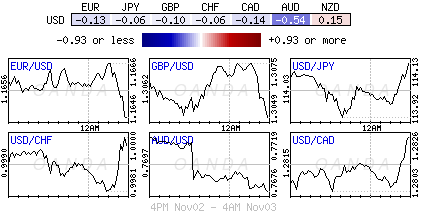

The ‘mighty’ dollar is holding steady across the board, a day after the greenback had slipped after Republicans in the U.S House of Representatives released proposals to overhaul the U.S tax code. Congressional passage of this legislation is far from certain, and reasons enough for the dollar to see ‘red.’

President Trump’s nomination yesterday of Jerome Powell to be the next Fed chair came as no surprise. To bond dealers, his successful nomination is considered more of the same – broadly extending the path that the Fed reinforced at this week’s meeting – a hike in December and more to come in 2018.

Elsewhere, the U.S trade balance and Canadian unemployment numbers (08:30 am EDT) will also help to set this morning’s trading tone.

1. Stocks mixed reaction

Asian equities were mixed overnight after Wall Street reacted uncertainly to emerging details of the U.S tax change proposals.

Note: Japanese markets were closed Friday for a holiday.

Down-under, Australian stocks stood out, hitting fresh 2017 highs on gains in commodity prices. Australia’s S&P/ASX 200 Index rallied +0.5%, while South Korea’s Kospi index rose by +0.4%.

In Hong Kong, stocks ended firmer overnight, as China slowdown worries were offset by the upbeat mood from strength on Wall Street. The Hang Seng index rose +0.3%, while the China Enterprises Index was unchanged.

Note: For the week, the Hang Seng was up +0.6%, but the HSCE lost -0.4%.

In China, the major indexes slid on Friday to end the week lower, led by Shanghai stocks posting their worst week in three-months, as weak growth in the service sector last month heightened investor worries about an economic slowdown. The blue-chip CSI300 index eased -0.1%, while the Shanghai Composite Index closed down -0.4%.

Note: For the week, CSI300 lost -0.7%, while SSEC dropped -1.3%.

In Europe, regional indices trade mostly higher across the board with the exception of the Spanish Ibex ahead of October’s U.S jobs report..

U.S stocks are set to open in the ‘black’ (+0.1%).

Indices: Stoxx600 +0.2% at 395.6, FTSE +0.3% at 7576, DAX +0.4% at 13493, CAC-40 flat at 5511, IBEX-35 -0.9% at 10359, FTSE MIB +0.1% at 23064, SMI +0.1% at 9291, S&P 500 Futures +0.1%

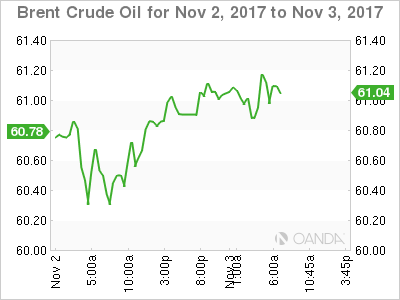

2. Oil edges up to near two-year highs as market tightens, gold unchanged

Oil prices remain better bid, trading atop of their two-year highs, as the outlook remains upbeat, as OPEC-led supply cuts have tightened the market and drained inventories.

Brent crude is up +13c, or +0.2% at +$60.62 per barrel. The contract is up by more than a third from its 2017-lows in June. U.S light crude (WTI) is up +24c, or +0.4% at +$54.54, almost +30% above its 2017-lows in June.

Investor confidence has been supported by an effort this year lead by OPEC and Russia to hold back about -1.8m bpd in oil production to tighten markets.

On Thursday, the Saudi Energy Minister Khalid al-Falih said supply and demand balances were tightening and oil inventories falling, while compliance with the OPEC-led pact to curb supplies had been “excellent”.

Note: Overall, oil markets have been slightly undersupplied this year, resulting in inventory drawdowns and the OPEC pact to withhold supplies runs to March 2018, but there is growing consensus to extend the deal to cover all of next year.

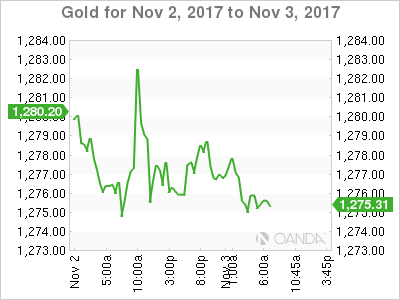

Ahead of the U.S open, gold prices are trading in a narrow range as the U.S dollar trades steady amid caution ahead of non-farm payrolls (NFP). Spot gold is mostly unchanged at +$1,275.82 per ounce, and is on track for its first weekly gain in three. Yesterday, the ‘yellow’ metal hit its highest in about two weeks at +$1,284.10 an ounce.

3. Sovereign yields fall

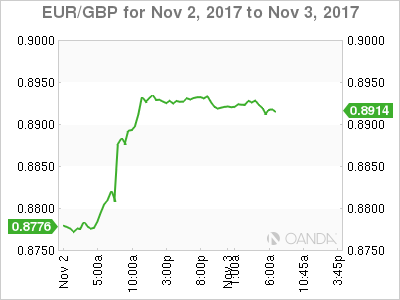

U.K bond yields haven fallen in the past 24-hours after yesterday’s BoE’s announcement of the first rate hike in ten-years (+25 bps to +0.50%). The 7 to 2 vote spilt, and the removal from the minutes of previous reference to monetary policy tightening by more than markets expect, meant that the move has been interpreted as a ‘dovish’ or ‘token’ hike.

U.K’s 10-year gilt yield has declined -2 bps to +1.335%, the lowest in almost seven weeks.

In the U.S, the gap between 5- and 30-year Treasuries yields have shrank to the narrowest in almost a decade. The market has been happy to drive down longer-end yields after President Trump said he would nominate Jerome Powell to run the Federal Reserve from February.

Powell has shown a ‘Yellen-esque’ sensitivity towards emerging markets and a gradual U.S rate path – extending the path that that Fed members reinforced at this week’s FOMC meeting – a hike in December and more to come in 2018.

The yield on U.S 10-year Treasuries has backed up +1 bps to +2.35%.

4. ‘Big’ dollar waiting for jobs headline

The FX market is holding steady after President Trump nominated Jerome Powell as the new Federal Reserve chair. Investors will take their cues from this morning’s U.S non-farm payrolls (NFP). This morning’s headline print is expected to keep the door ajar for a December Fed rate hike.

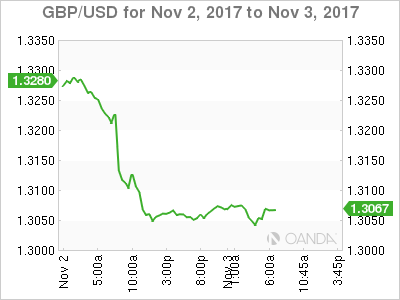

GBP/USD (£1.3067) continues its soft tone following yesterday’s dovish rate hike by the BoE, but off its intraday lows after this morning’s U.K services PMI print (see below) came in better than expected.

In yesterday’s BoE statement, dealers noted that BoE dropped the wording that “interest rates may need to rise more than markets expected” and that Governor Carney had now linked the future path of rates to the outcome of the Brexit talks.

5. U.K services sector grows at fastest rate in six months

Data this morning showed that Business activity in the U.K’s service sector grew last month at the fastest pace in six-months and significantly faster than anticipated.

IHS Markit Ltd. said its purchasing managers index for the services industry -which accounts for some +80% of the U.K economy – rose to 55.6 in October, up from 53.6 in September, and above market expectations that forecasted a -0.2 point drop. The growth in activity was supported by improved order books and resilient client demand, the survey indicated.

Today’s data goes some way’s to justify yesterday’s first BoE rate hike in a decade.

However, the pace of job creation slowed to a seven-month low, and sentiment about future growth prospects remained subdued amid Brexit uncertainty and concerns about business investment.