Summary

In the latest pause on tariff implementation, the window for deal-making is extended, but so too is the uncertainty that complicates capital spending decisions. This report unveils our latest tariff tracker featuring increased visibility into our process.

Pause Offers an Extended Window for Deal-Making

The post-Liberation day selloff in financial markets played a role in putting many of the most far-reaching aspects of the tariffs on ice. The net effect was not to eliminate the effective tariff rate, but rather to take it down from a Liberation Day peak of ~30% to something closer to 14% for the better part of the intervening weeks. The scheduled deadline of July 9 has been met with another pause, pushing off the implementation date for many countries to August. But, it is not entirely clear that every country has benefited from this stay of execution.

But What is the Tariff Rate in the Meantime?

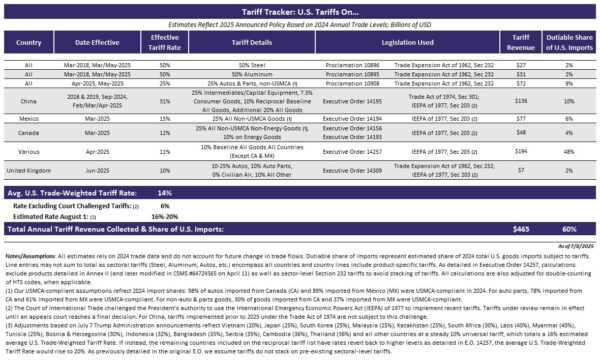

Our latest update of our Tariff Tracker reflects our attempt to comb through the various Executive Orders, Presidential Proclamations and social media posts to distill what it all means for trade and import costs. The ever-changing framework can make this effort a pencil-snapping frustration, but our best efforts put the current effective tariff rate at 14% based on current policy. That could rise to 16% by the start of August based solely on this week’s country-specific announcements (the letters to the 15 impacted countries on July 7) and to as high as 20% if tariffs revert higher for the remaining 40 or so countries on the original reciprocal-tariff list from early April.

Putting off the increased levy will no doubt bring some short-term relief for impacted business owners and purchasing managers, though it does little to alleviate the pervasive sense of uncertainty that has scope to pare capital spending plans in the back half of the year. In the latest ISM manufacturing index, nine out of ten respondents from various industry groups called out tariffs as an impediment to activity in their sectors.

No Secret to Our Approach

We’ve put our methodology for the Tariff Tracker right in the tool itself in the “Notes/Assumptions” section. The goal is to be more transparent and show exactly how we landed where we did. The tracker pulls trade data at the detailed-HTS code level for each policy designated in the Presidential Documents section of the Federal Register. We adjust for things like tariff exclusions and double counting.

We don’t claim to be experts on international trade law or even the inner workings of trade policy. Rather, this tool is intended as a macroeconomic resource and our best-effort attempt at tallying the potential broad impact of the trade war on the U.S. economy.

Source: U.S. Department of Commerce and Wells Fargo Economics