- We expect the ECB to leave the deposit rate unchanged at 2.0% on Thursday 18 December in line with consensus and market pricing.

- • Data has come in stronger than expected by ECB staff, so we expect an upward revision to the growth forecasts amid inflation little changed.

- • We see the ECB holding rates steady at 2.0% in both 2026 and 2027 due to inflation undershooting in contrast to market expectations of 37 bp worth of hikes.

- We expect a muted market reaction as Lagarde will likely signal ECB being on hold for a while, reiterating the ‘good place’ assessment.

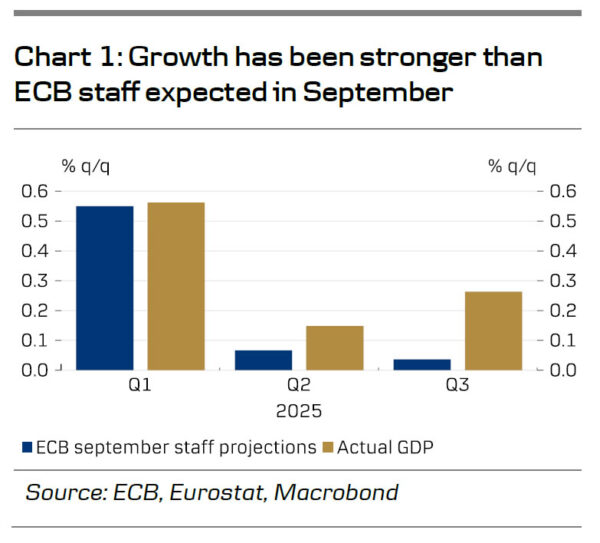

We expect the ECB to leave the deposit rate unchanged at 2.0% at the meeting on December 18, in line with consensus and market pricing. Since the last meeting both inflation, growth, and wages have come in stronger than expected by the ECB. The euro area economy grew 0.3% q/q in Q3 compared to 0.0% q/q projected (see chart 1), core inflation is set to average 2.4% y/y in Q4 compared to the 2.2% projection, and wage growth rose to 4.0% y/y in Q3 in contrast to an expected decline to 3.2% by the ECB staff. These positive data surprises combined with the decent PMIs in both October and November support the “good place” assessment of the ECB, thereby reducing the chances of further rate cuts.

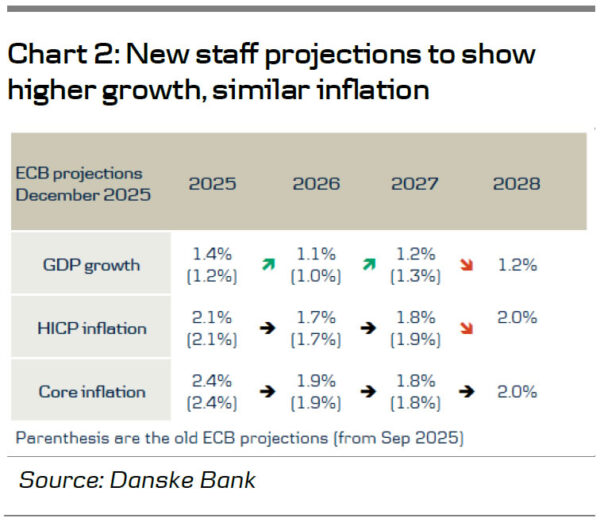

The meeting will also unveil new staff projections, including 2028 for the first time. We expect growth forecasts to rise to 1.4% y/y for 2025 (from 1.2%) and 1.1% y/y for 2026 (from 1.0%), with 1.2% for both 2027 and 2028. Inflation is likely to remain largely unchanged, except for a revision to 1.7% y/y for 2027 (from 1.8%) due to the delayed ETS2, with 2028 projected at 2.0% y/y (see chart 2). While growth is likely revised up headline and core inflation is at the same projected below target in both 2026 and 2027, which we believe limits the case for rate hikes by the ECB. We therefore see the ECB holding rates steady at 2.0% in both 2026 and 2027.

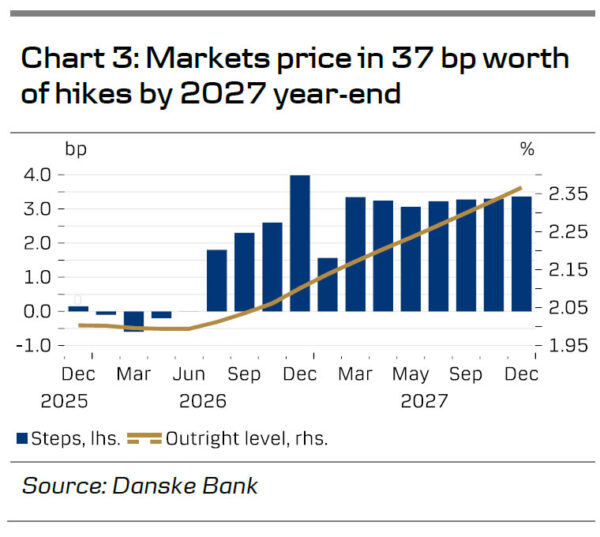

There is a growing disagreement within the ECB on the rate outlook where Schnabel sees inflation risks tilted to the upside and thereby is “comfortable” with market pricing that the next move will be a hike. This comment combined with stronger than expected wage growth has fueled a significant reprising of the outlook for the ECB, with expectations for cuts next year completely erased and markets now pricing 37bp worth of hikes before 2027 year-end (see chart 3). A push-back against Schnabel’s comments by Villeroy saying he sees “no reason to raise ECB rates soon” and Simkus expecting 2% “at further meetings” has done little to alleviate the pressure in the market.

While we have long had a paying bias in the short end of the euro swap curve, we cautiously believe that the magnitude of recent moves is overdone. Yet, we highlight the rise in real rates is due to the expectation of stronger growth and not lower inflation, which means that a pushback from the ECB is less pressing. On the back of this, we believe that Lagarde will signal that they will be on hold for a while, reiterating that the ECB is in a good place, data-dependent, and not pre-committing to a particular rate path. We therefore expect a limited market reaction.