- April Advance U.S retail sales m/m: +0.3% vs. +0.3%e

- Retail sales ex-autos: +0.3% vs. +0.5%e

- Retail sales ex-auto and gas: +0.3% vs. +0.4%e

Americans ramped up spending in April. U.S retail sales rose a seasonally adjusted +0.3% in April.

Digging deeper, spending growth was largely broad-based, with food and beverage stores and clothing and accessories retailers both booking the largest sales gains since 2017. Disappointment was found at restaurants and bars, declining -0.3% m/m.

Gas-station sales rose +0.8% in April m/m, support mostly by the pick up in gas prices.

Compared with a year earlier, retail sales were up +4.7% in April, with spending continuing to outpace inflation, with the consumer-price index rising +2.5% in April from a year earlier.

New York manufacturers report strong May growth

The Empire State Manufacturing Survey’s general business conditions index grew to 20.1 in May from 15.8 the previous month. Market expectations were looking for a reading of 15.

Digging deeper, the prices-paid index rose to its highest level in seven years, growing to 54 in May from 47.4 in April, indicating significant input price pressures. The prices-received index increased to 23 from 20.7.

The new orders index rose to 16 from 9, as the shipments index climbed to 19.1 from 17.5, pointing toward ongoing growth in orders and shipments.

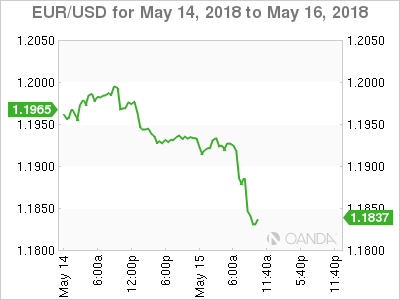

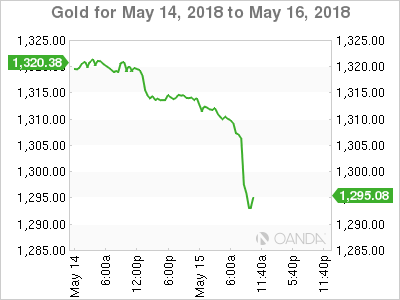

The USD continues to make broad-based gains across the board (€1.1834, £1.3465, ¥110.23 and C$1.2920). U.S 10-year yield continues to back up, +3 bps to +3.054%, while gold trades atop of the key support at $1,304.30