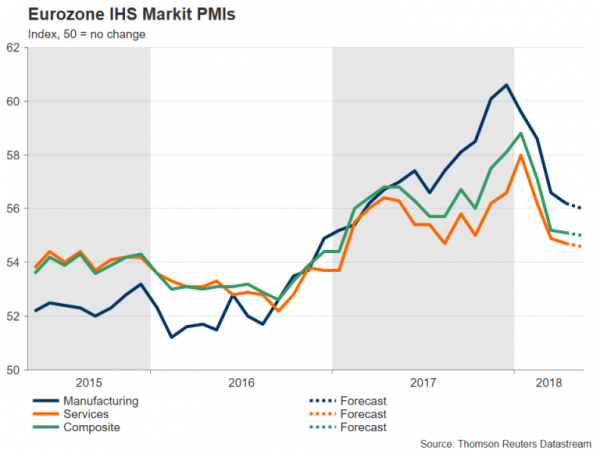

Flash PMI readings out of the Eurozone on Wednesday (due at 08:00 GMT) will be closely scrutinized by investors as they will be looking for signs that economic activity is picking up following a substantial slowdown between February and April. However, those hoping for an end to the soft patch are likely to be disappointed as the PMI indicators are forecast to fall further in May.

After soaring to a near 12-year high in January, the euro area’s composite PMI, consisting of manufacturing and services activity, fell to a more than one-year low in April, as growth in the region continued to lose steam. The slowdown has been mostly blamed on temporary factors, such as cold weather, labour strikes and supply constraints. Meanwhile, rising global trade tensions have dented investor confidence, particularly in Germany.

Wednesday’s data from IHS Markit is expected to show the composite PMI easing marginally from 55.1 to 55.0 in May’s flash reading. The manufacturing PMI is forecast to decline from 56.2 in April to 56.0 in May, while the services PMI is expected to slip from 54.7 to 54.6. If confirmed, the slower pace of decline would indicate that growth is bottoming out and a rebound could be just around the corner. A key aspect of the report to watch will be the expectations about future outlook by Eurozone businesses and whether they are improving, as further gloom could be interpreted as a sign that the slowdown is becoming more protracted.

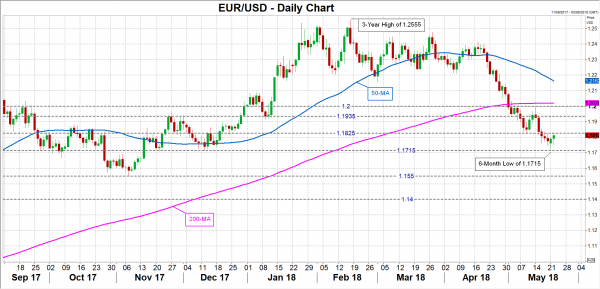

The euro is at risk of falling to fresh yearly lows against the US dollar if the data fails to point to an end to the weak patch. Immediate support for euro/dollar is currently being provided by the 1.1715 level (Monday’s 6-month low), but renewed downside pressure could push the pair towards 1.1550, near the November 2017 low of 1.1552. Deeper losses would bring the 1.14 handle into scope.

However, should the data beat expectations or at the least, provide some evidence of growth recovering, the euro could be set for a sharp upside correction, especially as technical indicators suggest the current sell-off is overdone. A fresh buying interest could lift the pair above immediate resistance around 1.1825. Higher up, resistance is likely to come from around 1.1935, followed by the 1.20 handle.