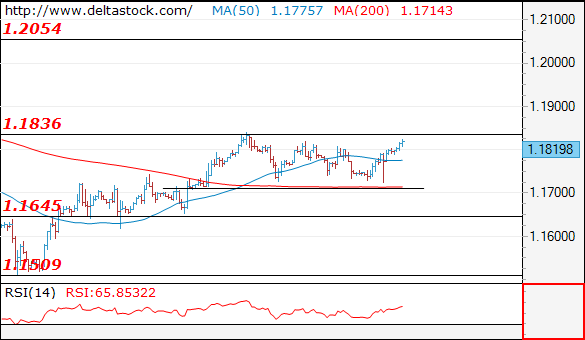

EUR/USD

Current level – 1.1819

The corrective pattern below 1.1830 is over with yesterday’s low at 1.1725 and the bias is positive, for a break through 1.1836, towards 1.2050 zone. The market could remain on hold till ECB rate announcement today and unwind a bullish move afterwards.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1830 | 1.1830 | 1.1710 | 1.1480 |

| 1.1900 | 1.2060 | 1.1650 | 1.1300 |

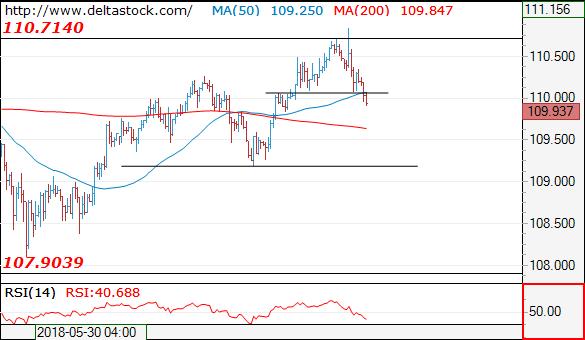

USD/JPY

USD/JPY

Current level – 109.93

The short-lived spike to 110.80 was the final leg of the upmove since 108.10 low and my outlook is bearish, for a slide towards 109.20, en route to 107.90.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 110.70 | 111.40 | 109.20 | 107.80 |

| 111.40 | 114.40 | 107.80 | 106.70 |

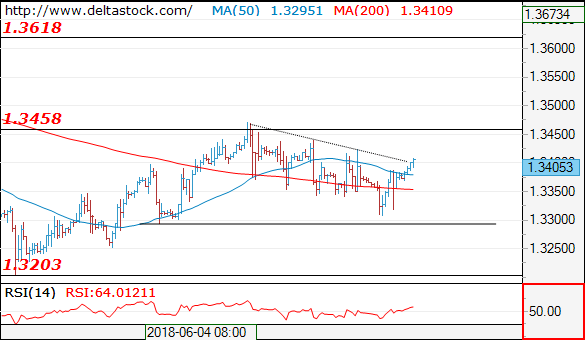

GBP/USD

Current level – 1.3405

Yesterday’s dip to 1.3306 should be enough to complete the consolidation pattern below 1.3460 and my outlook is already bullish, for a break through the mentioned hurdle, towards 1.3620 area.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.3460 | 1.3618 | 1.3290 | 1.3210 |

| 1.3620 | 1.3990 | 1.3290 | 1.3040 |