Key Highlights

- The Euro traded above the 1.1700 level before facing resistance near 1.1730 against the US Dollar.

- There was a break below a connecting bullish trend line with support at 1.1645 on the 4-hour chart of EUR/USD.

- The Euro Area CPI in August 2018 (Prelim) increased 2% (YoY), less than the 2.1% forecast.

- The Euro Zone Manufacturing PMI for August 2018 will be released today, which is forecasted to remain at 54.6.

EURUSD Technical Analysis

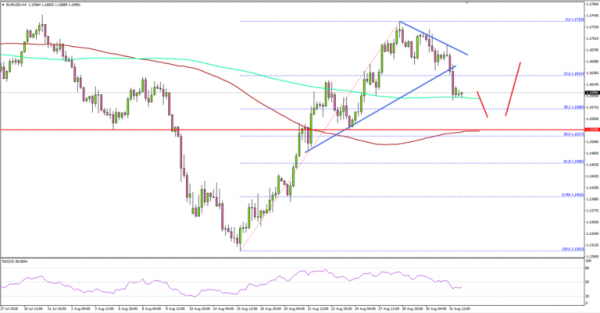

The Euro made a nice upward move this past week and traded above the 1.1640 and 1.1700 resistances against the US Dollar. The EUR/USD pair traded as high as 1.1733 and later started a downside correction.

Looking at the 4-hours chart, the pair declined below the 1.1700 support level to move into a short-term bearish zone. It even broke the 23.6% Fib retracement level of the last move from the 1.1301 low to 1.1733 high.

More importantly, there was a break below a connecting bullish trend line with support at 1.1645 on the same chart. The next support on the downside is near the 1.1550 level.

However, it seems like the pair could test the 1.1517 level, which is the 50% Fib retracement level of the last move from the 1.1301 low to 1.1733 high. The 100 simple moving average (red, 4-hours) is also positioned near the 1.1520 level.

Therefore, if the pair continues to move down, it could find support near 1.1515-1.1520. On the upside, the pair may struggle to break the 1.1650 and 1.1680 levels (the previous supports).

Fundamentally, the Euro Area CPI report for August 2018 (Prelim) was released by the Eurostat. The market was looking for a rise of 2.1% in the CPI in August 2018 compared with the same month a year ago.

The actual result below the market forecast as the CPI posted 2.0%. Moreover, the Core CPI increased 1.0%, whereas the market was looking for a 1.1% rise.

The report added that:

Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in August (9.2%, compared with 9.5% in July), followed by food, alcohol & tobacco (2.5%, stable compared with July), services (1.3%, compared with 1.4% in July) and non-energy industrial goods (0.3%, compared with 0.5% in July).

Overall, the Euro may continue to move down in the short term towards the 1.1550 or 1.1520 support level.

Economic Releases to Watch Today

- Germany’s Manufacturing PMI for August 2018 – Forecast 56.1, versus 56.1 previous.

- Spanish Manufacturing PMI for August 2018 – Forecast 52.5, versus 52.9 previous.

- Euro Zone Manufacturing PMI August 2018 – Forecast 54.6, versus 54.6 previous.

- UK Manufacturing PMI for August 2018 – Forecast 53.8, versus 54.0 previous.