Key Highlights

The US Dollar started a downside correction after trading as high as 114.53 against the Japanese Yen.

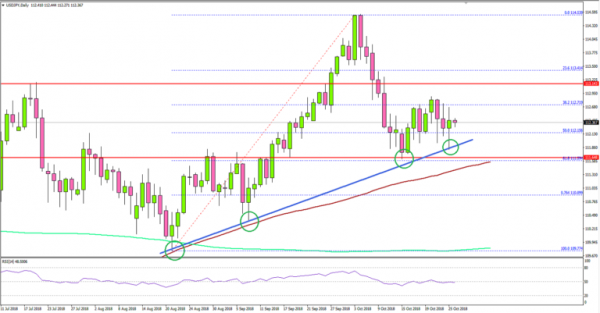

There is a crucial bullish trend line formed with support at 111.90 on the daily chart of USD/JPY.

The US Durable Goods Orders in Sep 2018 increased 0.8%, better than the -0.9% forecast.

Today, the US Gross Domestic Product for Q3 2018 (Preliminary) will be released, which is forecasted to grow 3.3%.

USDJPY Technical Analysis

After a solid upward move, the US Dollar faced sellers near 114.50 against the Japanese Yen. The USD/JPY pair formed a high at 114.53 and later started a downside move.

Looking at the daily chart, the pair declined below the 113.10 and 112.80 support level to move into a short term bearish zone. Moreover, there was a break below the 50% Fib retracement level of the last wave from the 109.77 low to 114.53 high.

However, the decline was limited by the 111.50 support area and a crucial bullish trend line with current support at 111.90 on the same chart. Besides, the 61.8% Fib retracement level of the last wave from the 109.77 low to 114.53 high also acted as a support.

As long as the pair is above the trend line support and 111.80, the pair could resume its upside move. An initial resistance is near the 113.00-113.10 zone, above which the pair could trade towards the 113.80 level.

On the other hand, a downside break below the trend line and 111.80 may possibly push the pair towards the 111.00 support.

Fundamentally, the US Durable Goods Orders report for Sep 2018 was released by the US Census Bureau. The market was looking for a decline in orders by around 0.9%.

The result was positive as the US Durable Goods Orders increased by 0.8% in Sep 2019, but it was less than the last revised reading of +4.6%.

Overall, the market sentiment supports the US Dollar, which means pairs like EUR/USD and GBP/USD may perhaps continue to struggle in the near term.

Economic Releases to Watch Today

- US Gross Domestic Product Q3 2018 (Preliminary) – Forecast 3.3% versus previous 4.2%.

- US Personal Consumption Expenditures Prices for Q3 2018 (QoQ) (Preliminary) – Forecast +2.0%, versus +2.0% previous.

- US Core Personal Consumption Expenditures for Q3 2018 (QoQ) (Preliminary) – Forecast +1.8%, versus +2.1% previous.