Bitcoin has broken some key levels and serious questions are being raised about price stability. In addition to this, the concept of limited supply is under a huge threat, the developer community really need to stick together otherwise and stop the process of forking.

The crypto king is being hit hard and it is under tremendous selling pressure. Today marks the eighth consecutive day of sell off for Bitcoin. It is down nearly 78 percent from its all-time peak of nearly $20K (depending on which exchange you look at).

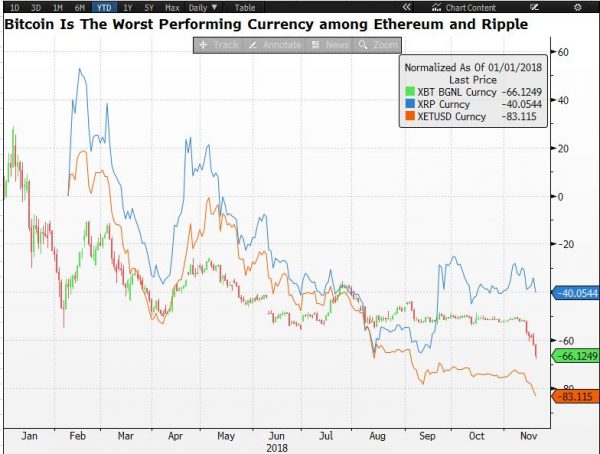

Year-to-date, the price is down nearly 69.26%. At the time of writing, the price is trading at $4,391. All other major cryptocurrencies are feeling the burnt. Ethereum, the second biggest cryptocurrency, has touched $121, a level not seen since May 2017. XRP, a token associated with Ripple, is by far the strongest coin now and it has gained the number 2 position once again (according to coinmarketcap.com).

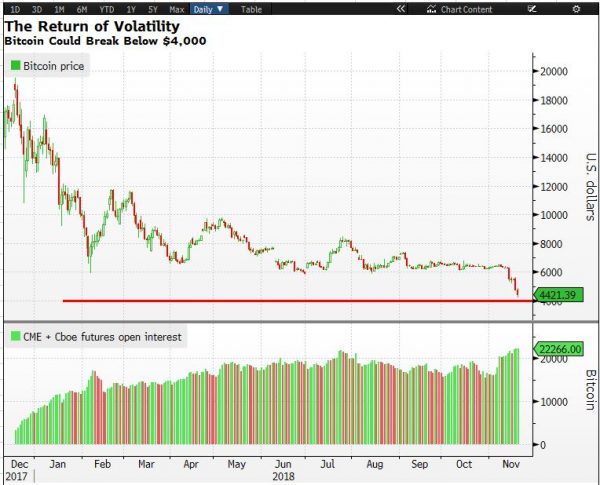

The open interest for Bitcoin futures on CME group and CBOE exchanges has jumped to 22,266 hitting an all-time high. Open interest is by definition a measure of market activity, or simply put the flow of money into the futures market. Higher open interest means new money joining the market and lower open interest means fewer investors are interested in this market.

Bitcoin broke the $5,000 mark yesterday for the first time, breaking yet another psychological level. This made the sentiment sour. The break of $6,000 was the first major psychological level to be broken and now a violation of the $5,000-mark is further evidence that the bulls are not supporting the price. The next big support level is at $4,000. One can only pray that the price doesn’t break below this critical level because this would open the floor towards the $3,000 level.

Fundamentally speaking, the current sell-off is due to two main reasons; regulatory pressure and disagreement within the coin developer community, one of the biggest threats. The SEC reminded the crypto world that it has the final say over anything that smells like a security. The department issued civil penalties against two cryptocurrency companies because they failed to register initial coin offerings as securities. Investors will be given their refund and the firms will have to face fines. The fear is that the SEC may not stop here and might take similar action against several companies that adopted a similar path.

The community needs to stick together and work towards a more meaningful fork. This is because, developers, on the one hand, try to convince the world that the supply is limited and, on the other hand, they keep looking at ways of triggering another kind of forks. Forking has become so common that it puts at risk the notion of limited supply altogether.