The Euro made a nice upside move and climbed above 129.00 against the Japanese Yen. The British Pound is currently holding an important support at 144.60, and GBP/JPY could bounce back.

Important Takeaways for EUR/JPY and GBP/JPY

The Euro gained momentum recently and traded above the 128.80 resistance against the Japanese Yen.

There is a major connecting resistance trend line in place at 129.30 on the hourly chart of EUR/JPY.

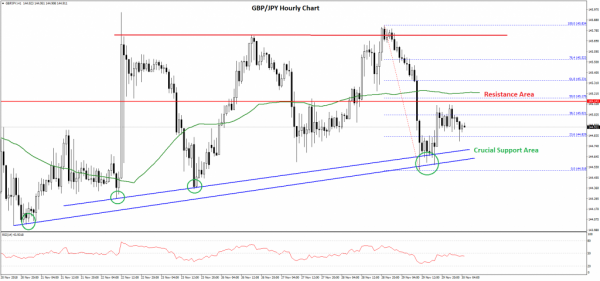

GBP/JPY is consolidating above two major bullish trend lines with support near 144.60 on the hourly chart.

The pair must break the 145.15 resistance to start a decent upward move.

EUR/JPY Technical Analysis

The Euro found a decent buying interest near the 128.30 and 128.40 support levels against the Japanese Yen. The EUR/JPY pair started an upside wave and traded above the 128.80 and 129.00 resistance levels.

The pair gained strength and settled above the 129.00 barrier and the 50 hourly simple moving average. It traded close to the 129.30 level where it faced sellers. A high was formed at 129.29 on FXOpen and later the pair corrected lower.

It declined below the 23.6% Fib retracement level of the last wave from the 128.67 low to 129.29 high. However, there are many supports on the downside near the 129.00 and 128.90 levels.

The 129.00 support coincides with the 50% Fib retracement level of the last wave from the 128.67 low to 129.29 high. Below 129.00, the 50 hourly SMA is positioned near the 128.90 level. Finally, there is a solid bullish trend line in place with support at 128.70 on the hourly chart.

On the upside, the pair must break the 129.30 and 129.40 resistance levels. There is also a major connecting resistance trend line in place at 129.30 on the same chart.

Therefore, a successful close above the trend line resistance and 129.40 could open the doors for more gains towards the 129.80 and 130.00 levels in the near term.

GBP/JPY Technical Analysis

The British Pound struggled to break the 145.80 and 146.00 resistance levels on many occasions against the Japanese Yen. The GBP/JPY pair recently formed a high near the 145.83 level and declined heavily.

The pair dropped below the 145.50 and 145.00 support levels. The decline was such that there was a close below the 145.00 handle and the 50 hourly simple moving average. It traded as low as 144.51 and later started consolidating losses.

It corrected above the 23.6% Fib retracement level of the recent drop from the 145.83 high to 144.51 low. However, there is a strong resistance formed near the 145.15 level and the 50 hourly SMA.

The stated 145.15 resistance is also near the 50% Fib retracement level of the recent drop from the 145.83 high to 144.51 low. Therefore, a close above the 145.15 and 145.20 levels may push the price back in a bullish zone. The next hurdles for buyers are near the 145.80 and 146.00 levels.

On the downside, there is a decent support formed near the 144.75 and 144.60 levels. More importantly, there are two major bullish trend lines in place with support near 144.60 on the hourly chart. If there is a close below trend lines, GBP/JPY could decline towards 144.00 or 143.60.