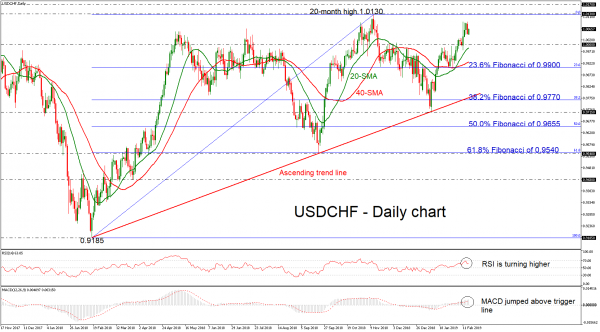

USDCHF has moved considerably higher after the touch on the ascending trend line, recording a new three-month high of 1.0097 on Thursday. The price climbed well above the 20- and 40-simple moving averages (SMAs) in the daily timeframe, while the RSI is sloping marginally up in the positive zone and the MACD oscillator is strengthening its momentum above the trigger and zero lines.

Should the pair continue to head higher the next level to have in mind is the 20-month high of 1.0130, achieved on November 13. A successful break of this barrier would endorse the bullish tendency and open the way towards 1.0170, identified by the peak on March 2017, while steeper increases could open the way towards the 1.0340 resistance, taken from the highs on December 2016.

On the flipside, if the price slips below the strong psychological level of 1.0000, this could endorse chances for downside movements until the immediate support of the 20-day SMA currently at 0.9990. Below this level, the pair could stop around the 40-day SMA around 0.9925 and then at the 23.6% Fibonacci region of 0.9900.

In the medium-term, the outlook should remain strongly bullish if the price fails to slip beneath the significant diagonal line, which has been standing since February 2018.