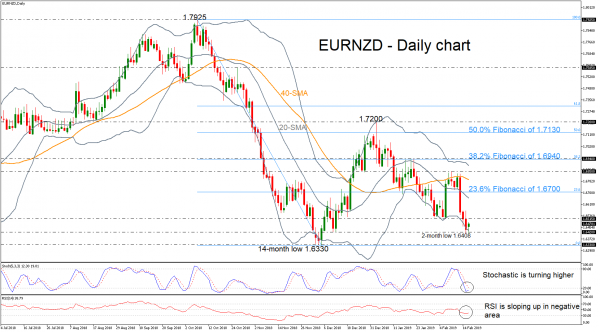

EURNZD has declined considerably over the previous three days, recording a new two-month low around 1.6408 and touching the lower Bollinger Band. Currently, the price is paring some of the losses, approaching the 1.6500 handle. Technical indicators in the daily timeframe are reversing back to the upside. The stochastic oscillator is turning higher in the oversold zone, signaling bullish pressure, while the RSI indicator is pointing up in the bearish area.

In the event of an upside reversal, the 23.6% Fibonacci retracement level of the downleg from 1.7925 to 1.6330, near 1.6700 could act as a barrier in case the price jumps above 1.6515. A break above this level would take the pair above the 40-day simple moving average towards the 1.6850 resistance.

Further losses should see the December 14-month low of 1.6330 acting as a major support. A drop below this region would reinforce the bearish structure in the medium term and open the way towards the next key support level of 1.6140, identified by the bottom on September 2017.

In the medium-term picture, euro/kiwi is trying to extend its bearish view, posting a negative tendency. A new lower low below 1.6330 would confirm this structure.