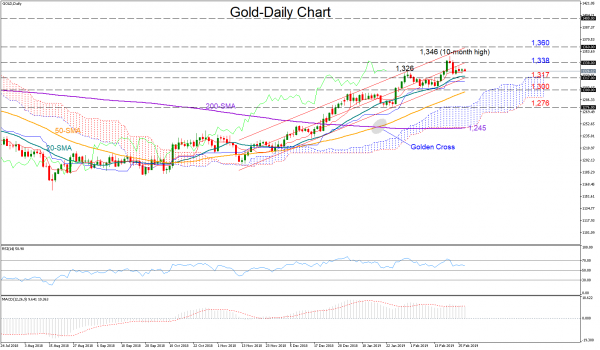

Gold retreated to meet its previous peak of 1,326 after hitting a 10-month high at 1,346 last week as the RSI pierced into overbought zone. With the indicator now pointing to the downside and towards its 50 neutral mark and the MACD weakening below its red signal line but above zero, the bias is seen as neutral in the short term.

Moving southwards, a key support is expected to be challenged at the bottom of the ascending channel near 1,317. A clear negative breakout of the upward pattern could shift attention to 1,300 where the 50-day moving average (MA) is currently placed. Below that, the bears would aim to drive the price below the 200-day MA (1,245) but before that they may take a break around January’s trough of 1,276.

Should bullish forces return, the middle line of the channel at 1,338 and the top at 1,346 would come on the radar. Yet only a decisive step out of the trading channel could boost positive sentiment, with resistance running next to 1,400.

In the bigger picture, the outlook is positive thanks to the higher highs and higher lows registered since early August. The bullish cross between the 50- and the 200-day MAs could be taken as a sign that the bullish sentiment is not near to end.