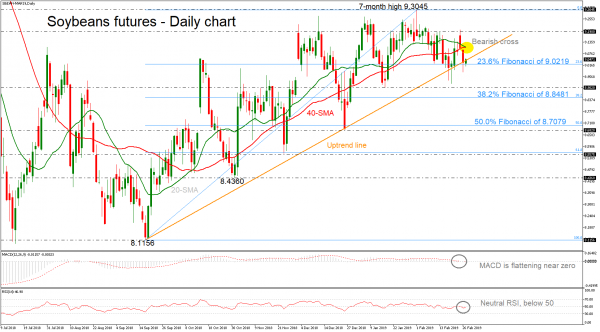

Soybeans futures pulled back on the medium-term ascending trend line and the 23.6% Fibonacci retracement level of the upleg from 8.1156 to 9.3045 near 9.0219, confirming the medium-term upside rally in the daily timeframe. Currently, the price is trading below the bearish cross within the 20- and 40-simple moving averages (SMAs), pointing to a possible fall below the trend line. The MACD and the RSI are flattening near their neutral levels, suggesting that the recent view is weakening.

A decline below the 23.6% Fibonacci of 9.0219 and the diagonal line could shift the positive picture to a more neutral one, challenging the 8.9020 support. Beneath this level, the 38.2% Fibonacci of 8.8481 could act as strong support before heading towards the 50.0% Fibonacci of 8.7079.

Alternatively, if the price jumps above the SMAs, the next level to turn traders’ attention could be the 9.1900 resistance barrier. More advances could push the price towards the seven-month high of 9.3045 resistance.

Summarizing, Soybeans maintains a bullish bias in the medium-term timeframe, recording higher highs and higher lows. This structure could be confirmed once again if the market surpasses the upper multi-month high, registered on February 1.