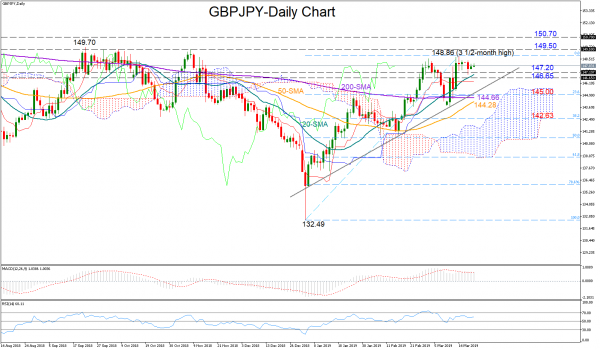

GBPJPY slid sideways after it found strong resistance just shy of the 149 handle for the second time this month. In the short term, the consolidation phase may continue as the RSI has yet to show clear direction, while the MACD is easing towards its red signal line, backing this view as well. Nevertheless, as long as the former holds above 50 and the latter above its red line, chances for upside movements are higher.

On the upside, the pair would push hard to breach its previous peak of 148.86, which is the highest reached in more than 3 months. Topping this level, a more concrete barrier could probably appear around 149.50. Should the market break this ceiling as well, the next key resistance could arise near 150.70.

In the negative scenario, a decline below the 147.20-146.65 support area could pressure the price towards 145, located in the crossroads of the 23.6% Fibonacci level of the upleg from 132.49 to 148.86 and the upward trendline drawn from the 135.79 low. A decisive close below that point and more importantly a drop under the 50-day moving average currently at 144.28 could trigger a steeper sell-off, shifting attention down to the 38.2% Fibonacci of 142.63.

Turning to the medium-term picture, GBPJPY is maintaining a positive profile thanks the higher highs and higher lows registered during the past three months. A rally above the 149.50 may confirm the start of a new bullish cycle.