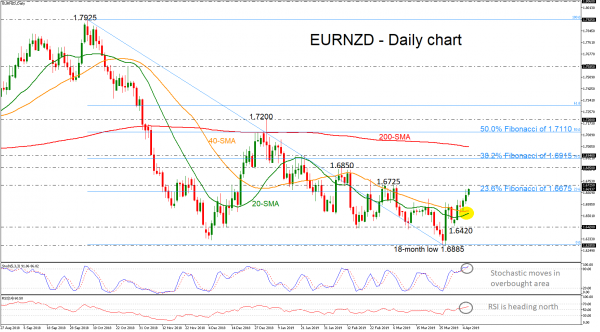

EURNZD reached overbought levels according to the stochastic oscillator as the price hovers above the 23.6% Fibonacci retracement level of the downward movement from 1.7925 to 1.6885, around 1.6675, recording a fresh one-month high, today.

While the aforementioned technical indicator continues to stand above 80, mirroring the market’s bullish behavior over the past couple days, it is also flagging that a recovery could reemerge in the short term. The RSI is also holding above its 50 level, which supports the positive view as well, while the 20-day simple moving average keeps approaching the 40-day SMA for a bullish cross.

In case the pair maintains its medium-term direction to the upside, the bulls will probably challenge the previous top at 1.6725. A break higher, could last until 1.6850 ahead of the 38.2% Fibonacci mark of 1.6915.

Alternatively, declines may drive the price towards the 20- and 40-SMAs near 1.6530 before the 1.6420 support comes into view. Beneath the latter, the 18-month low of 1.6885 which rejected the market’s bearish action recently could be another level in focus.

Concluding, in the short-term, if the price surpasses 1.6725 and have a daily close above this level, it could open the door for more bullish orders until the next resistance.