Key Highlights

- Gold price started a solid rebound after trading as low as $1,280.80 against the US Dollar.

- There was a break above a crucial declining channel with resistance at $1,292 on the 4-hours chart of XAU/USD.

- The US NFIB Business Optimism Index increased from 101.7 to 101.8 in March 2018.

- The US Consumer Price Index in March 2019 could increase 0.3% (MoM), less than the last 0.2%.

Gold Price Technical Analysis

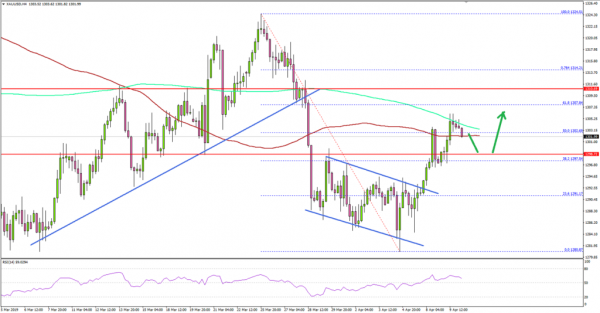

After a sharp decline, gold price found support near the $1,280 level against the US Dollar. The price started a strong rebound recently and climbed above the $1,290 and $1,294 resistance levels.

The 4-hour chart of XAU/USD indicates that the price broke a strong resistance area near the $1,290 and 1,291 levels. The price also surpassed the 23.6% Fib retracement level of the last decline from the $1,324 high to $1,280 low.

Moreover, there was a break above a crucial declining channel with resistance at $1,292 on the same chart, opening the doors for more gains. Recently, the price broke the $1,300 resistance, the 100 simple moving average (red, 4-hours) and the 50% Fib retracement level of the last decline from the $1,324 high to $1,280 low.

All these are positive signs, but there are many hurdles on the upside near the $1,310 level. Besides, there are many important economic releases lined up in the US today, including the CPI report and FOMC meeting minutes.

If gold price continues to move higher and clears the $1,310 resistance, it could revisit the $1,324 high. On the flip side, a close below the $1,294 support might trigger a fresh drop.

Looking at the major pairs, EUR/USD rebounded above the 1.1240 level, but GBP/USD is still struggling below the 1.3150 resistance.

Economic Releases to Watch Today

- UK Industrial Production for Feb 2019 (MoM) – Forecast +0.1%, versus +0.6% previous.

- UK Manufacturing Production for Feb 2019 (MoM) – Forecast +0.2%, versus +0.8% previous.

- ECB Interest Rate Decision – Forecast 0%, versus 0% previous.

- US Consumer Price Index March 2019 (MoM) – Forecast +0.3%, versus +0.2% previous.

- US Consumer Price Index March 2019 (YoY) – Forecast +1.8%, versus +1.5% previous.

- US Consumer Price Index Ex Food & Energy March 2019 (YoY) – Forecast +2.1%, versus +2.1% previous.

- FOMC Meeting Minutes.