Key Highlights

- The US Dollar rallied and traded to a new 3-year high above 1.0200 against the Swiss Franc.

- USD/CHF broke a crucial ascending channel near 1.0060 on the 4-hours chart and surged higher.

- The US New Home Sales in March 2019 increased 4.5% (MoM), whereas the forecast was -2.5%.

- The BoC Interest Rate Decision will be announced today (forecast – no change from 1.75%).

USDCHF Technical Analysis

The US Dollar started a strong uptrend from the 0.9980 support area against the Swiss Franc. The USD/CHF pair climbed steadily, followed a bullish path, and recently rallied to trade to a new 3-year high above 1.0220.

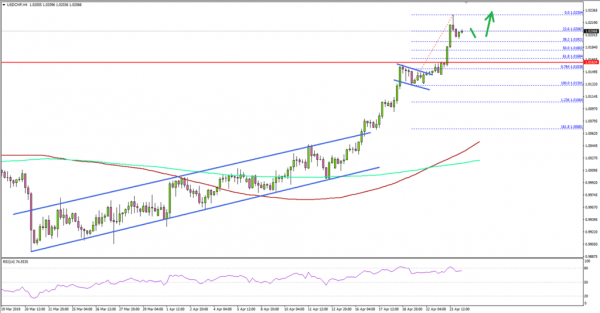

Looking at the 4-hours chart, the pair started a significant upward move from the 0.9978 swing low. There was a steady rise inside a crucial ascending channel. Finally, there was an upside break above the channel resistance at 1.0060.

It opened the doors for further gains above 1.0100, the 100 simple moving average (4-hours, red), and the 200 simple moving average (4-hours, green). Intermediately, there were bullish continuation patterns formed, and the pair rallied above the 1.0200 resistance level.

The pair even broke the 1.0220 level and traded as high as 1.0230. The pair is currently trading in a strong uptrend and dips towards the 1.0200 and 1.0160 levels remain supported. On the upside, the next key resistance are near 1.0250 and 1.0275.

Fundamentally, the US New Home Sales report for March 2019 was released by the US Census Bureau. The market was looking for a decline of 2.5% in sales in March 2019, compared with the previous month.

The actual result was positive as there was a strong rise of 4.5% in sales. Besides, the last reading was revised up from 4.9% to 5.9%.

The report added that:

The seasonally‐adjusted estimate of new houses for sale at the end of March was 344,000. This represents a supply of 6.0 months at the current sales rate.

Overall, the US Dollar remains in a strong uptrend and pairs like EUR/USD and GBP/USD may continue to struggle in the near term.

Economic Releases to Watch Today

- German IFO Business Climate Index April 2019 – Forecast 99.9, versus 99.6 previous.

- Swiss ZEW Survey Expectations April 2019 – Forecast -24.0, versus -26.9 previous.

- BoC Interest Rate Decision – Forecast 1.75%, versus 1.75% previous.