Key Highlights

- The British Pound traded higher recently and broke the 145.00 resistance against the Japanese Yen.

- GBP/JPY broke a connecting bearish trend line with resistance at 144.90 on the 4-hours chart.

- The US ADP Employment in April 2019 changed 275K, better than the 180K forecast.

- Today, the BoE Interest Rate Decision is scheduled in the UK (forecast – no change from 0.75%).

GBPJPY Technical Analysis

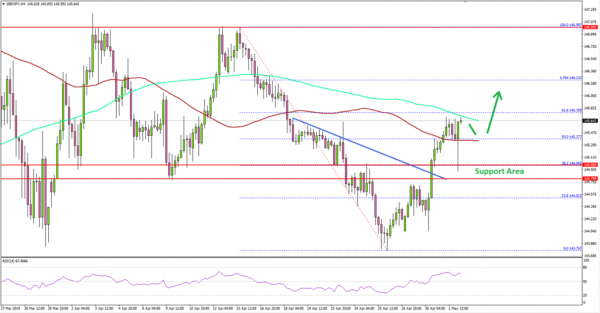

After a strong decline, the British Pound found support near the 143.75 level against the Japanese Yen. The GBP/JPY pair started an upward move and broke the 144.00 and 145.00 resistance levels.

Looking at the 4-hours chart, the pair broke many important resistances near the 144.80 and 145.00 levels. There pair surpassed the 50% Fib retracement level of the last decline from the 146.99 high to 143.75 low.

Besides, there was a break above a connecting bearish trend line with resistance at 144.90 on the same chart. Finally, the pair settled above the 145.40 level and the 100 simple moving average (red, 4-hours).

On the upside, an immediate resistance is near 145.75, the 200 simple moving average (green, 4-hours), and the 61.8% Fib retracement level of the last decline from the 146.99 high to 143.75 low.

If there is a successful close above the 145.75 and 145.80 resistance levels, GBP/JPY is likely to accelerate higher above the 146.00 and 146.20 resistance levels.

On the other hand, if there is a downside correction, the previous resistance near 145.40 and the 100 simple moving average (red, 4-hours) are likely to provide support.

Overall, GBP/JPY is trading nicely with a positive bias and it is likely to climb further above 146.00 in the near term. GBP/USD too recovered recently and broke the key 1.3000 resistance level. Today in the UK, the BoE Interest Rate Decision is scheduled, which might impact the market sentiment for the British Pound.

Economic Releases to Watch Today

- Germany’s Manufacturing PMI for April 2019 – Forecast 44.5, versus 44.5 previous.

- Euro Zone Manufacturing PMI April 2019 – Forecast 47.8, versus 47.8 previous.

- US Initial Jobless Claims – Forecast 215K, versus 230K previous.

- US Factory Orders March 2019 (MoM) – Forecast +1.5%, versus -0.5% previous.

- BoE Interest Rate Decision – Forecast 0.75%, versus 0.75% previous.