Key Highlights

- Gold price started a fresh increase above $1,285 and $1,290 resistances against the US Dollar.

- A key bullish trend line is forming with support at $1,290 on the 4-hours chart of XAU/USD.

- The US Import Price Index advanced 0.2% in April 2019 (MoM), less than the +0.7% forecast.

- The US Retail Sales in April 2019 could increase 0.2% (MoM), less than the last +1.6%.

Gold Price Technical Analysis

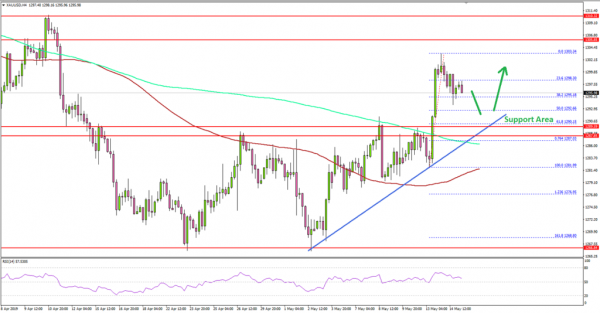

After forming a support base above $1,265, gold price started a strong upward move against the US Dollar. The price broke the key $1,280 and $1,290 resistance levels to move into a positive zone.

The 4-hours chart of XAU/USD indicates that the price gained bullish momentum after it broke the $1,288 pivot level and the 100 simple moving average (4-hours, red).

Finally, there was a close above $1,292 and the 200 simple moving average (4-hours, green). It opened the doors for more gains and the price climbed above $1,300. A swing high was formed near $1,303 and the price is currently correcting lower.

An immediate support is near $1,292 and the 50% Fib retracement level of the latest wave from the $1,281 swing low to $1,303 high. More importantly, there is a key bullish trend line forming with support at $1,290 on the same chart.

The main support is near $1,290 and the 61.8% Fib retracement level of the latest wave from the $1,281 swing low to $1,303 high. As long as the price is above $1,290 and the 200 SMA, it is likely to continue higher.

A break above the recent high at $1,303 might push the price towards the $1,308 and $1,310 resistance levels in the near term.

Looking at the major pairs, EUR/USD failed once again near the 1.1265 resistance area and GBP/USD traded below a couple of important supports near the 1.2950 level.

Economic Releases to Watch Today

- German GDP Q1 2019 (YoY) (Prelim) – Forecast 0.7%, versus 0.6% previous.

- German GDP Q1 2019 (QoQ) (Prelim) – Forecast 0.4%, versus 0% previous.

- Euro Zone GDP Q1 2019 (QoQ) (Prelim) – Forecast 0.4%, versus 0.4% previous.

- Euro Zone GDP Q1 2019 (YoY) (Prelim) – Forecast 1.2%, versus 1.2% previous.

- US Retail Sales April 2019 (MoM) – Forecast +0.2%, versus +1.6% previous.

- Canadian Consumer Price Index April 2019 (MoM) – Forecast +0.3%, versus +0.7% previous.

- Canadian Consumer Price Index April 2019 (YoY) – Forecast +1.7%, versus +1.9% previous.