Key Highlights

- The British Pound is trading in a downtrend below the 1.2800 support against the US Dollar.

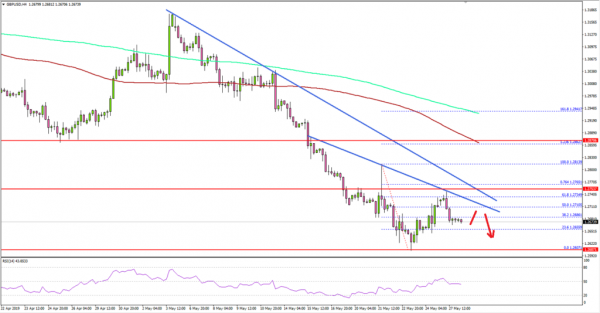

- Two bearish trend lines are formed near 1.2735 on the 4-hours chart of GBP/USD.

- There is a risk of more downsides unless the pair settles above 1.2800.

- The US Consumer Confidence in May 2019 could increase from 129.2 to 130.1.

GBPUSD Technical Analysis

This past week, the British Pound declined heavily below 1.3000 and 1.2920 against the US Dollar. The GBP/USD pair even traded to a new monthly low at 1.2607 and settled below the 1.2800 support.

Looking at the 4-hours chart, the pair started a short term upside correction after trading as low as 1.2607. There was a decent increase above the 1.2680 and 1.2700 resistance levels.

Besides, there was a break above the 50% Fib retracement level of the downward move from the 1.2813 high to 1.2607 low. However, the recovery was capped by the 1.2740-1.2750 resistance area.

More importantly, the pair failed to stay above the 61.8% Fib retracement level of the downward move from the 1.2813 high to 1.2607 low. There are also two bearish trend lines are formed near 1.2735 on the same chart.

Therefore, a clear break above both trend lines and follow through above the 1.2765 level is needed for a decent recovery. Having said that, the main hurdle for buyers is near the 1.2800 level.

As long as the pair is trading below the 1.2800 pivot level, there is a risk of more downsides. An initial support is near the 1.2635 level, below which the pair could even break the 1.2600 support.

Conversely, if there is an upside break and close above 1.2800, GBP/USD might start a strong recovery towards the 1.3000 level.

Looking at EUR/USD, the pair seems to be struggling near the 1.1225 level, whereas USD/JPY could correct higher in the short term.

Economic Releases to Watch Today

- Germany’s GfK Consumer Confidence June 2019 – Forecast 10.4, versus 10.4 previous.

- Euro Zone Economic Sentiment Indicator May 2019 – Forecast 108.1, versus 107.9 previous.

- Euro Zone Business Climate Indicator May 2019 – Forecast 108.1, versus 107.9 previous.

- US Consumer Confidence May 2019 – Forecast 130.1, versus 129.2 previous.