We’re seeing some more profit taking in gold on Tuesday, with the rebound in the dollar and stronger risk appetite likely contributing to the declines.

Gold failed to break above $1,350 on this occasion, or hold above the February high, but that doesn’t necessarily mean the rally has run its course. Price has now fallen back towards $1,320 which could be an interesting test, having previously been a notable area of resistance. A rotation off here could see last week’s highs coming under pressure again.

Gold Daily Chart

A break below here wouldn’t be particularly concerning though, as the rally that preceded it was very strong. We’ve only seen the rally correct by around a third now – a level that will be of interest to traders – but a deeper correction is hardly a red flag. The $1,300-1,310 area could be much more interesting, at which point we’ll get a much better idea of just how bullish this market is.

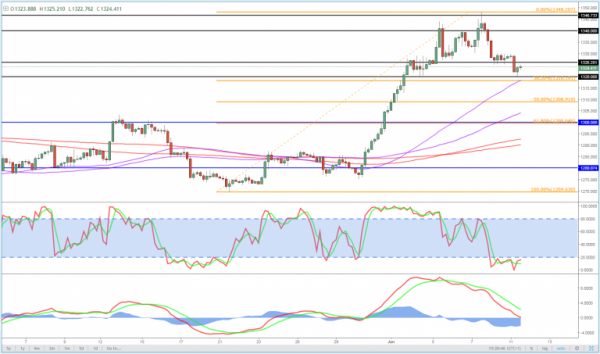

Gold 4-Hour Chart

As you can see on the chart above, the momentum indicators don’t show any divergences forming at this point, which may support the view that a deeper correction is on the cards.