Key Highlights

- The Euro failed to gain momentum above 1.1350 and trimmed most gains against the US Dollar.

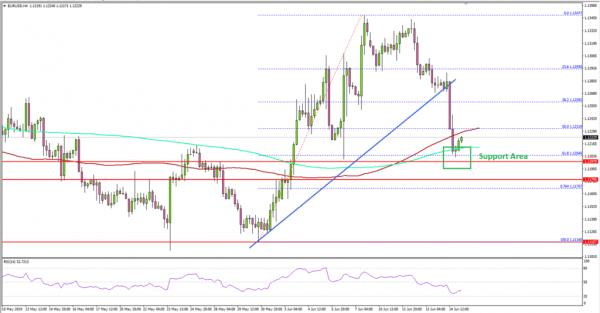

- EUR/USD traded below a connecting bullish trend line with support near 1.1280 on the 4-hours chart.

- The US Industrial Production in May 2019 increased 0.4% (MoM), more than the +0.2% forecast.

- The NY Empire State Manufacturing Index in June 2019 could decline from 17.80 to 12.75.

EURUSD Technical Analysis

The Euro traded close to the 1.1350 resistance area against the US Dollar. However, the EUR/USD pair failed to remain in the positive zone and started a major drop below the 1.1300 level.

Looking at the 4-hours chart, the pair topped near 1.1347 and declined below the 50% Fib retracement level of the upward move from the 1.1116 swing low to 1.13487 high.

Moreover, the pair traded below a connecting bullish trend line with support near 1.1280 on the same chart. The pair even broke the 1.1250 support level and the 100 simple moving average (red, 4-hours).

It tested the 1.1200 support area and the 61.8% Fib retracement level of the upward move from the 1.1116 swing low to 1.13487 high. If the pair settles below 1.1200, there are chances of a sharp decline below the 1.1180 and 1.1170 support levels.

The next key supports are near 1.1150 and 1.1140. Conversely, if the pair stays above 1.1200, it could consolidate in the short term before a fresh increase.

An initial resistance is near the 1.1240 level. If there is a successful close above 1.1250 plus the 100 simple moving average (red, 4-hours), then the pair will most likely revisit the 1.1300 level.

Fundamentally, the US Industrial Production report for May 2019 was released by the Board of Governors of the Federal Reserve. The market was looking for a 0.2% rise in May 2019, compared with the previous month.

The actual result was above the market forecast, as there was a 0.4% rise in the US Industrial Production. Moreover, the last reading was revised up from -0.5% to -0.4%.

The report stated that:

The indexes for manufacturing and mining gained 0.2 percent and 0.1 percent, respectively, in May; the index for utilities climbed 2.1 percent. At 109.6 percent of its 2012 average, total industrial production was 2.0 percent higher in May than it was a year earlier.

Overall, EUR/USD is trading near the key 1.1200 support area. It could either start a fresh increase or decline further towards 1.1150 in the near term.

Economic Releases to Watch Today

- NY Empire State Manufacturing Index June 2019 – Forecast 12.75, versus 17.80 previous.

- NAHB Housing Market Index June 2019 – Forecast 66, versus 66 previous.