Key Highlights

- The US Dollar failed to surpass the 1.3430-1.3440 resistance zone against the Canadian Dollar.

- USD/CAD traded below a major bullish trend line with support at 1.3390 on the 4-hours chart.

- Canada’s Consumer Price Index (CPI) increased 0.4% (MoM), more than the +0.2% forecast.

- The US Initial Jobless Claims for the week ending June 15, 2019 might decline from 222K to 220K.

USDCAD Technical Analysis

Earlier this month, the US Dollar formed a strong support near 1.3250 and later climbed higher against the Canadian Dollar. The USD/CAD pair traded above 1.3350, but it recently struggled to surpass the 1.3430-1.3440 resistance zone.

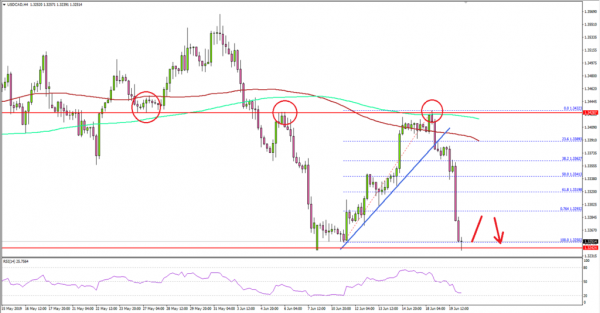

Looking at the 4-hours chart, the pair failed near 1.3432 level and the 200 simple moving average (green, 4-hours). As a result, the price dropped below the 1.3400 support and the 100 simple moving average (red, 4-hours).

Moreover, the pair traded below a major bullish trend line with support at 1.3390 on the same chart. It even cleared the 76.4% Fib retracement level of the upward move from the 1.3250 low to 1.3432 high.

The pair is currently trading near the last swing low at 1.3250, and if it continues to decline, there could be further losses below 1.3250.

The next major support is near the 1.3220 level, below which USD/CAD could retest 1.3200. An intermediate support is near 1.3210 or the 1.236 Fib extension level of the upward move from the 1.3250 low to 1.3432 high.

On the upside, an initial resistance is near the 1.3300 level. However, the main resistance is near the 1.3430 and 1.3440 levels. A successful close above 1.3440 plus the 200 simple moving average (green, 4-hours) is must to start an uptrend.

Fundamentally, the Canadian Consumer Price Index (CPI) for May 2019 was released by the Statistics Canada. The market was looking for a 0.2% rise in the CPI compared with the previous month.

The actual result was above the market forecast, as the CPI increased 0.4% in May 2019 (MoM). Looking at the yearly change, there was a 2.4% increase, more than the +2.1% forecast and well above the last +2.0%.

The report added:

Prices increased year over year in all eight major components in May, with six components growing at faster rates and two components growing at the same pace compared with April. Higher prices for food (+3.5%) and transportation (+3.1%) contributed to the increased growth in the all-items index.

Overall, the report helped the Canadian Dollar, but USD/CAD could still bounce back as long as it is above the 1.3250 support area.

Economic Releases to Watch Today

- UK Retail Sales for May 2019 (YoY) – Forecast +2.7%, versus +5.2% previous.

- UK Retail Sales for May 2019 (MoM) – Forecast -0.5%, versus 0% previous.

- BoE Interest Rate Decision – Forecast 0.75%, versus 0.75% previous.

- US Initial Jobless Claims – Forecast 220K, versus 222K previous.