Key Highlights

- Gold price gained significantly above $1,400 and $1,420 against the US Dollar.

- A key bullish trend line is forming with support near $1,412 on the 4-hours chart of XAU/USD.

- The US New Home Sales in May 2019 declined 7.8% (MoM), whereas the forecast was +1.9%.

- The US Durable Goods Orders in May 2019 might increase 0.2%.

Gold Price Technical Analysis

After a successful close above the $1,400 resistance, gold price accelerated gains against the US Dollar. The price even broke the $1,420 resistance and traded close to $1,440 before correcting lower.

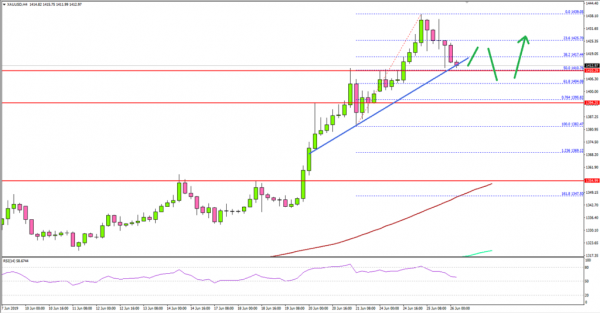

The 4-hours chart of XAU/USD indicates that the price settled nicely above the $1,425 level. It is now trading well above the 100 simple moving average (4-hours, red) and the 200 simple moving average (4-hours, green).

The last swing high was formed at $1,439 before the price corrected below the $1,430 level. There was a break below the 23.6% Fib retracement level of the last wave from the $1,382 low to $1,439 high.

However, the correction found support near the $1,412 level and the price stayed above the 50% Fib retracement level of the last wave from the $1,382 low to $1,439 high.

More importantly, there is a key bullish trend line forming with support near $1,412 on the 4-hours chart of XAU/USD. As long as the price is trading above the trend line, it could climb again above the $1,420 and $1,425 levels in the coming sessions. Conversely, it could slide towards the $1,400 support before a fresh increase.

Fundamentally, the US New Home Sales report for May 2019 was released by the US Census Bureau. The market was looking for a 1.9% rise in sales in May 2019, compared with the previous month.

However, the actual result was very disappointing since there was a 7.8% drop in sales. On the other hand, the last reading was revised up from -6.9% to -3.7%.

The report stated:

Sales of new single‐family houses in May 2019 were at a seasonally adjusted annual rate of 626,000. This is 7.8 percent (±14.7 percent) below the revised April rate of 679,000 and is 3.7 percent (±15.0 percent) below the May 2018 estimate of 650,000.

Overall, the US Dollar seems to be struggling to recover, resulting in positive moves in EUR/USD, GBP/USD and gold price.

Economic Releases to Watch Today

- US Durable Goods Orders May 2019 – Forecast +0.2% versus -2.1% previous.

- US Nondefense Capital Goods Orders Ex Aircraft May 2019 – Forecast +0.1% versus -1.0% previous.

- US Wholesale Inventories April 2019 (preliminary) – Forecast +0.5%, versus +0.8% previous.