Key Highlights

- The US Dollar topped near 109.00 and recently declined against the Japanese Yen.

- USD/JPY traded below a major bullish trend line with support near 108.25 on the 4-hours chart.

- The US CPI in June 2019 increased 0.1% (MoM), whereas the market was expecting no change.

- The US Producer Price Index is likely to remain flat in June 2019 (MoM).

USDJPY Technical Analysis

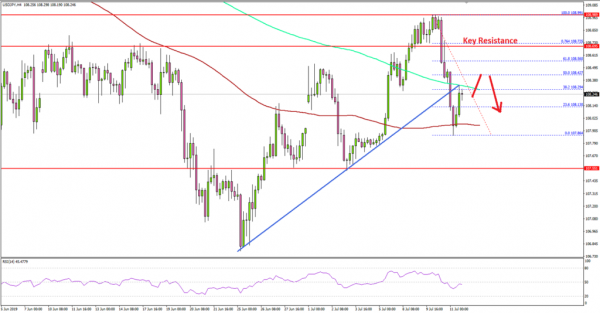

The US Dollar traded higher in the past few days above 108.00 and 108.50 against the Japanese Yen. However, the USD/JPY pair struggled to clear the 109.00 resistance and recently started a downside correction.

Looking at the 4-hours chart, the pair topped near the 108.99 level and traded below the 108.50 support area. Moreover, the pair traded below a major bullish trend line with support near 108.25.

It opened the doors for more losses below the 108.00 level and the 200 simple moving average (green, 4-hours). The pair traded towards the 107.80 support and corrected higher above the 23.6% Fib retracement level of the slide from the 108.99 high to 107.86 low.

However, the previous supports near 108.40 and 108.50 are likely to act as resistances and prevent a fresh increase. Should there be a close above 108.50, the pair might retest the 109.00 resistance.

Conversely, there is a risk of an extended decline below the 107.80 support level. The main support is near the 107.55 level, below which the pair may even slide towards 107.00.

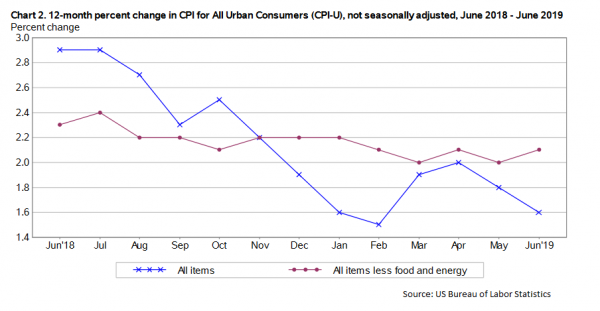

Fundamentally, the Consumer Price Index for June 2019 was released by the US Bureau of Labor Statistics. The market was looking for a no change compared with the previous month.

The actual result was above the market forecast, as there was a 0.1% rise in the CPI in June 2019. Looking at the yearly change, there was a 1.6% rise, similar to the forecast, but down from the last 1.8%.

The report added:

The energy index fell 2.3 percent as all of the major energy component indexes declined. The food index was unchanged as the index for food away from home rose but the index for food at home declined.

Overall, USD/JPY broke a few key supports and it seems like it could extend losses before starting a fresh increase towards the 109.00 level.

Economic Releases to Watch Today

- Euro Zone Industrial Production May 2019 (MoM) – Forecast +0.2%, versus -0.5% previous.

- US Producer Price Index June 2019 (MoM) – Forecast 0%, versus +0.1% previous.

- US Producer Price Index June 2019 (YoY) – Forecast +1.6%, versus +1.8% previous.