Cable remains in directionless mode for the fourth straight day, with repeated long-legged Dojis signaling strong indecision.

No significant reaction was seen from Wednesday’s new Brexit proposal by PM Johnson, as the EU officials in response described proposal as not basis for deal, keeping the situation in status quo, just few weeks ahead of 31 Oct deadline.

Both sides are preparing for two remaining scenarios – delay or disorderly no-deal Brexit, although Boris Johnson said that delay is not in his plans and if no deal will be reached until 31 Oct, the UK will leave the union without agreement.

Markets now focus EU summit on 17-18 Oct, which is seen as the last chance to find workable deal and solution for divorce.

Cable also showed mild reaction to disappointing UK Services PMI data (Sep 49.5 vs 50.3 prev).

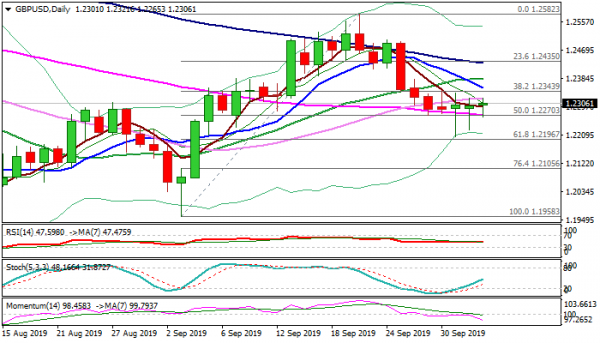

Mixed daily techs (rising bearish momentum / north-heading stochastic / MA’s in mixed setup) lack signals, keeping near-term action within two Fibo levels at 1.2270/43, as repeated spikes lower that cracked daily cloud base pivot (1.2227), were short-lived.

The pair is looking for a catalyst that would provide clearer direction signal.

Bearish scenario requires eventual close below 1.2270 pivot (daily Kijun-sen / 50% of 1.1958/1.2582) as initial negative signal which will need confirmation on extension below daily cloud base and nearby Fibo support at 1.2196 (61.8% of 1.1958/1.2582).

Conversely, lift above upper pivots at 1.2343 (broken Fibo 38.2% of 1.1958/1.2582) and 1.2355 (falling 55DMA) would generate bullish signal and shift focus towards daily cloud top (1.2399).

Res: 1.2322, 1.2343, 1.2355, 1.2399

Sup: 1.2270, 1.2227, 1.2204, 1.2196