Key Highlights

- The US Dollar started a fresh increase from the 106.50 support against the Japanese Yen.

- A key ascending channel is forming with support near 107.35 on the 4-hours chart of USD/JPY.

- The US CPI in Sep 2019 was unchanged, whereas the forecast was +0.1% (MoM).

- The Michigan Consumer Sentiment Index could decline from 93.2 to 92.0 in Oct 2019 (Prelim).

USD/JPY Technical Analysis

Earlier this month, the US Dollar declined below the 107.00 support against the Japanese Yen. USD/JPY tested the 106.50 support area and recently started a strong recovery above 107.00.

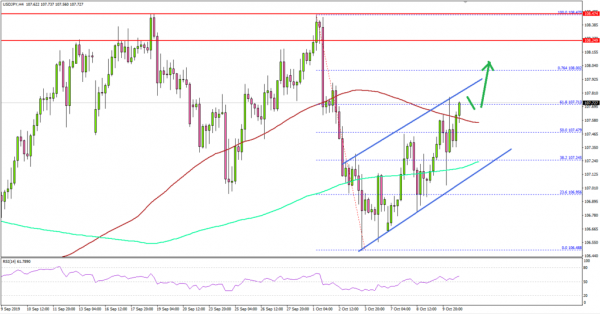

Looking at the 4-hours chart, the pair gained pace above the 107.20 resistance area and the 200 simple moving average (green, 4-hours). It opened the doors for more gains above 107.50.

The pair surpassed the 50% Fib retracement level of the downward move from the 108.47 high to 106.48 low. More importantly, there is a key ascending channel forming with support near 107.35 on the same chart.

On the upside, an initial hurdle is near the 108.00 level, which coincides with the 76.4% Fib retracement level of the downward move from the 108.47 high to 106.48 low.

Any further upsides could push the pair towards the key 108.25 and 108.45 resistance levels in the near term. Conversely, a downside break below the 107.20 and 107.00 support levels may perhaps spark a fresh decline towards 106.50 or even 106.20.

Fundamentally, the US Consumer Price Index for Sep 2019 was released by the US Bureau of Labor Statistics. The market was looking for a 0.1% rise in the CPI compared with the previous month.

The actual result was lower than the forecast, as there was no change in the CPI in Sep 2019. Looking at the yearly change, there was a 1.7% rise in the CPI, less than the market forecast of 1.8% and similar to the last 1.7%.

The report added:

The index for all items less food and energy rose 0.1 percent in September after increasing 0.3 percent in each of the last 3 months. Along with the shelter index, the indexes for medical care, household furnishings and operations, and motor vehicle insurance all rose in September.

Overall, USD/JPY might slowly rise towards 108.00 or 108.25. More importantly, EUR/USD started showing positive signs, but GBP/USD is still struggling to recover from the recent decline.

Upcoming Economic Releases

- German Consumer Price Index for Sep 2019 (YoY) – Forecast +1.2%, versus +1.2% previous.

- German Consumer Price Index for Sep 2019 (MoM) – Forecast 0%, versus 0% previous.

- Michigan Consumer Sentiment Index for Oct 2019 (Prelim) – Forecast 92.0, versus 93.2 previous.

- Canada’s Net Employment Change Sep 2019 – Forecast 10.0K, versus 81.1K previous.

- Canada’s Unemployment Rate Sep 2019 – Forecast 5.7%, versus 5.7% previous.