Key Highlights

- EUR/JPY is trading in a positive zone above the 120.00 support.

- The pair is facing a strong resistance near 121.50 on the 4-hours chart.

- The Euro Zone Services PMI in Oct 2019 increased from 51.8 to 52.2.

- The BoE Interest Rate Decision is scheduled today (forecast – no change in rates from 0.75%).

EUR/JPY Technical Analysis

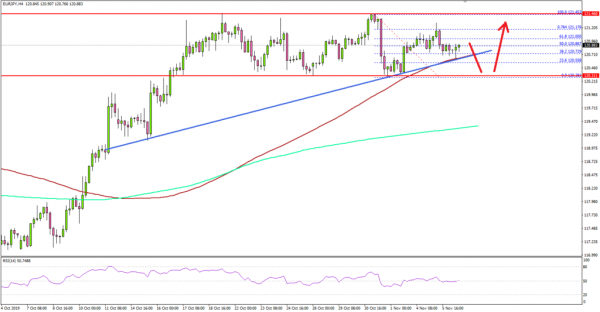

The Euro settled nicely above the 119.50 and 120.00 support levels against the Japanese Yen. However, EUR/JPY is facing a strong resistance near 121.50, above which it could rally towards 122.50.

Looking at the 4-hours chart, the pair made a few attempts to surpass the 121.45 and 121.50 resistance levels. However, the pair failed to continue higher and recently corrected lower.

On the downside, there are many supports near 120.40, 120.20 and 120.00. Moreover, there is a connecting bullish trend line forming with support near 120.70 on the same chart.

Therefore, the pair is likely to find a strong buying interest as long as it is above 120.00. If there is a daily close below 120.00 and the 100 simple moving average (red, 4-hours), there is a risk of a downside extension towards the 119.50 and 119.20 levels.

On the upside, an initial hurdle is near the 121.20 level. The main resistance is near the 121.50 area, above which the pair is likely to continue higher towards 122.00 and 122.50.

Fundamentally, the Euro Zone Services PMI for Oct 2019 was released by the Markit Economics. The market was looking for no change in the PMI from 51.8.

However, the actual result was above the market forecast, as the Euro Zone Services PMI increased from 51.8 to 52.2 in Oct 2019, moving away from the crucial 50.0 no-change mark.

The report added:

There remained a divergence between the manufacturing and service sectors during October. Whereas manufacturing firms recorded a ninth successive month of declining production, service sector companies indicated further growth, albeit at the second-weakest rate since January.

Overall, EUR/JPY could rise again unless it breaks the 120.00 support. Conversely, EUR/USD struggled recently and traded close to the 1.1050 support area. More importantly, GBP/USD is trading above 1.2850 and waiting for the BoE Interest Rate Decision today.

Upcoming Economic Releases

- BoE Interest Rate Decision – Forecast 0.75%, versus 0.75% previous.

- US Initial Jobless Claims – Forecast 215K, versus 218K previous.