EUR/USD

Current level – 1.1018

The EUR/USD is yet again trading around the 1.1017-20 level of resistance after the indecisive move towards the 1.0989 support from Friday. Despite the bounceback, expectations remain on the negative side and another test of the aforementioned level of support is probable. If broken, downside momentum should increase and it is possible to see the pair trading near the 1.0880 lows. In the less likely scenario in which the move up proves to be more than a minor retracement, first resistance for the bulls should be 1.1063, followed by 1.1089, but only a close above the latter will paint a more bullish picture. Today’s speech of the new ECB president – Lagarde – at 14:00 UK time could help bears overcome the support at around 1.0989 if she hints at more monetary stimulus. Traders will also be keeping an eye on the Manufacturing PMI in the US (14:45 UK time).

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1060 | 1.1140 | 1.0990 | 1.0880 |

| 1.1190 | 1.1170 | 1.0950 | 1.0880 |

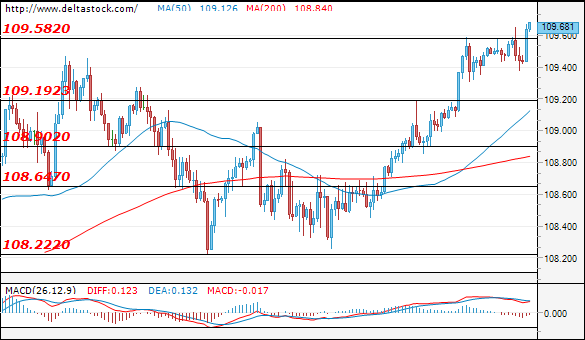

USD/JPY

Current level – 109.68

This week’s trading session started on a positive note and the dollar continues to gain more ground against the yen as the recent improvement in global macroeconomic data is driving investors away from safe havens. Looks like the Ninja (USD/JPY) is headed towards the psychological level at 110.00 and the next major resistance at around 110.50 and, unless there are major negative news regarding the trade war or the impeachment hearings in the US, the overall sentiment should remain positive. A retracement towards the first support at 109.19 remains a possibility.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 109.90 | 110.50 | 109.20 | 107.05 |

| 110.50 | 111.05 | 108.90 | 106.60 |

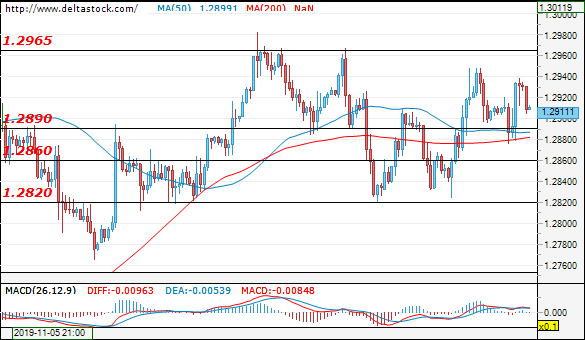

GBP/USD

Current level – 1.2911

Оn Friday, the GBP/USD did not manage to gain enough momentum to break the support at 1.2890 and is currently looking for a clear direction after the bounceback. Trading should continue in the range between 1.2820 and 1.2960 until there are fresh news around the looming elections in the UK. Expectations remain mostly neutral with a bullish note, and a more clear direction for the pair should be defined if Cable breaks either side of the range. The Manufacturing PMI data which is due at 09:30 UK time could help the GBP/USD find a fresh direction.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.2960 | 1.2965 | 1.2900 | 1.2700 |

| 1.3000 | 1.3000 | 1.2820 | 1.2670 |