The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.10786

Open: 1.10815

% chg. over the last day: +0.02

Day’s range: 1.10754 – 1.10790

52 wk range: 1.0884 – 1.1623

The EUR/USD currency pair is in a flat. The sentiment of financial market participants is mixed after comments by US President D. Trump regarding a trade agreement with China. Thus, the president said that he does not have a deadline for reaching a trade agreement with China, and perhaps it is better to wait until the end of the US presidential election in November 2020. Currently, the key support and resistance levels are 1.10650 and 1.10900, respectively. Open positions from these marks.

The Economic News Feed for 04.12.2019:

change in the number of employees in the non-agricultural sector by ADP (USA) – 15:15 (GMT + 2: 00);

ISM PMI (US) – 17:00 (GMT+2:00);

Indicators point to a bullish sentiment: the price is being traded above 50 MA and 100 MA.

The MACD histogram is in the positive zone, but below the signal line, which gives a weak signal to buy EUR/USD.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which also gives a signal to buy EUR/USD.

Trading recommendations

Support levels: 1.10650, 1.10300, 1.10000

Resistance levels: 1.10900, 1.11200

If the price consolidates above the resistance level of 1.10900, expect further growth toward 1.11200-1.11350.

Alternatively, the quotes could reduce toward 1.10300-1.10150.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.29486

Open: 1.29925

% chg. over the last day: +0.47

Day’s range: 1.29929 – 1.30007

52 wk range: 1.1959 – 1.3385

On the GBP/USD currency pair, a bullish sentiment is observed. Yesterday, the index of business activity in the UK construction sector was published, which amounted to 45.3 in November and turned out to be better than the predicted value of 44.5. Investors are awaiting additional information regarding the Brexit process. At the moment, the key support level is the mirror level of 1.29900. The key resistance level is 1.30500. We recommend opening positions from these marks.

The Economic News Feed for 04.12.2019:

Composite PMI (UK) – 11:30 (GMT+2:00);

Service PMI (UK) – 11:30 (GMT+2:00);

Indicators point to bullish sentiment: the price is being traded above 50 MA and 100 MA.

The MACD histogram is in the positive zone and above the signal line, which gives a strong signal to buy GBP/USD.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which also gives a signal to buy.

Trading recommendations

Support levels: 1.29900, 1.29500, 1.29100

Resistance levels: 1.30500, 1.30750

If the price consolidates above 1.29900, expect further growth toward 1.30750.

Alternatively, the quotes could fix below 1.29900 and decline toward 1.29500-1.29350.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.32971

Open: 1.32941

% chg. over the last day: -0.13

Day’s range: 1.32877 – 1.32979

52 wk range: 1.2727 – 1.3664

The USD/CAD currency pair is moving in several directions at once. Pressure on the USD is exerted by D. Trump’s statements regarding the US-China trade agreement. Currently, the local support and resistance levels are 1.32800 and 1.33000, respectively. Participants in financial markets expect additional drivers. We recommend paying attention to the dynamics of oil prices. Open positions from key levels.

Today, the Bank of Canada will decide on the interest rate at 17:00 (GMT+2: 00).

Indicators do not give accurate signals: the price has crossed 50 MA and 100 MA.

The MACD histogram is in the negative zone, but above the signal line, which gives a weak signal to sell USD/CAD.

The Stochastic Oscillator is in the neutral zone, the %K line crosses the %D line. There are no signals.

Trading recommendations

Support levels: 1.32800, 1.32650

Resistance levels: 1.33000, 1.33150, 1.33400

If the price consolidates below 1.32800, USD/CAD quotes are expected to decline to 1.32650-1.32400.

An alternative could be the growth of the USD/CAD currency pair to 1.33150-1.33300.

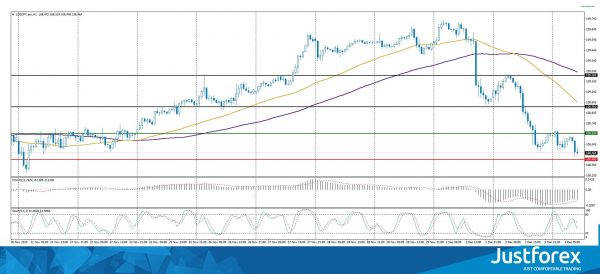

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 108.989

Open: 108.629

% chg. over the last day: -0.31

Day’s range: 108.440 – 108.519

52 wk range: 104.97 – 114.56

The USD/JPY currency pair went down. During yesterday’s trading, quotes fell by more than 70 points. Currently, the key support and resistance levels are 108.400 and 108.650, respectively. Investors are focusing on US-China relations. We also recommend that you pay attention to the dynamics of yield on US government bonds. Open positions from key levels.

The Economic News Feed for 04.12.2019 is calm.

Indicators point to the strength of sellers: the price is being traded below 50 MA and 100 MA.

The MACD histogram is in the negative zone, but above the signal line, which gives a weak signal to sell USD/JPY.

The Stochastic Oscillator is in the neutral zone, the %K line is below the %D line, which gives a signal to sell USD/JPY.

Trading recommendations

Support levels: 108.400, 108.150

Resistance levels: 108.650, 108.900, 109.200

If the price consolidates below 108.400, expect a further decline toward 108.150-108.000.

Alternatively, the quotes could consolidate above 108.650 and grow toward 109.000.