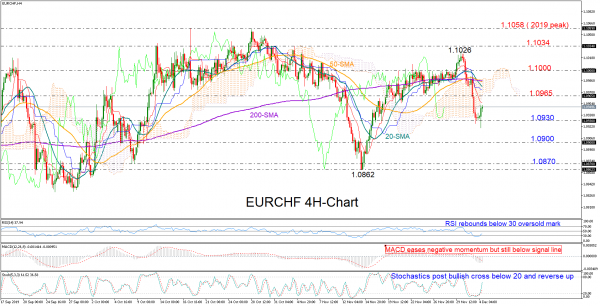

EURCHF came under sharp selling pressure after peaking at 1.1026 on Monday, with the price correcting below its simple moving averages and the Ichimoku cloud.

The downfall has now stalled around 1.0930 as the RSI and the Stochastics recover from oversold conditions. The MACD has also started to turn higher, and if it continues to improve and cross above its red signal line, the market could extend its latest upside reversal.

Still, a closing price comfortably above the 1.0965 barrier is what traders would potentially like to see to increase buying interest. If true, resistance could shift higher to 1.1000, where any violation at this point would bring the previous peaks within the 1.1026-1.1034 area back into view. Further up, the bulls would aim for the 2019 peak of 1.1059 registered on October 17 to upgrade the overall neutral picture in the market to a positive one.

In the negative scenario, a decline under 1.0930 could pause near 1.0900. Should sellers persist, the price could next rest around 1.0900 before a bigger battle starts within a tougher support area of 1.0870-1.0862.

Summing up, the bullish pressure seems to be strengthening in the EURCHF market. Yet only a decisive rally above 1.0965 would keep buyers in play.