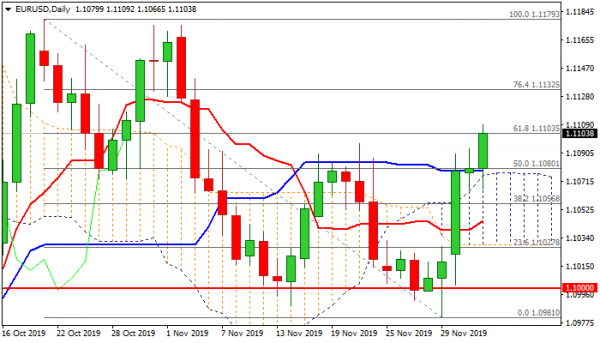

The Euro regained traction and jumped in early US trading on Wednesday, after weaker than expected US private sector employment data (ADP Nov 67K vs 140K f/c and downward-revised Oct 121K) hit the greenback. The pair traded in a sideways and choppy mode in Asia/Europe, elevated by stronger than expected EU/German Composite and Service PMI’s and also dragged by stronger pound, but was unable to break above the range ceiling. Near-term action remained above the top of thick daily cloud, following two consecutive daily closes above cloud, keeping bullish bias. Fresh strength broke above former high at 1.1096 and key Fibo barrier at 1.1103 (61.8% of 1.1179/1.0981, with daily close above the latter to generate bullish signal for further advance. Strong EU/German data reduce fears of bloc’s economy slowdown and support the Euro. Also, weak US ADP jobs report, which is also used as an indication for more significant Non-Farm Payrolls report (due on Friday), may signal that NFP could fall below expectations and increase pressure on dollar that would open way for further Euro’s recovery. Bulls eye target at 1.1132 (Fibo 76.4%) and may extend towards falling 200DMA (1.1160) and key barriers at 1.1175/79 (4 Nov/21 Oct double top) on stronger bullish acceleration. Daily studies are in full bullish setup and support the action, with price adjustments expected to interrupt rally and provide better opportunities for re-entering bullish market. Daily cloud top (1.1077) remains key support which needs to hold extended downticks.

Res: 1.1109; 1.1132; 1.1160; 1.1179

Sup: 1.1096; 1.1077; 1.1066; 1.1056