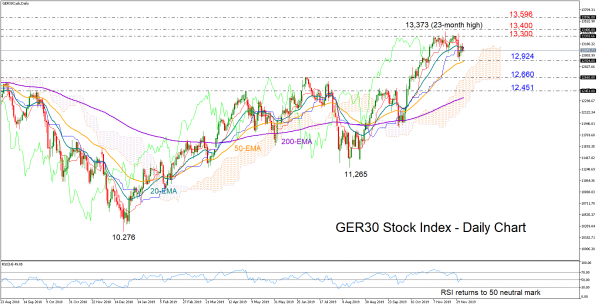

The GER30 stock index gave up some ground after stubbornly and unsuccessfully testing the 13,300 region for almost a month.

The short-term bias is now viewed as neutral, as the red Tenkan-sen has slowed to meet the blue Kijun-sen line, while the RSI is struggling to hold above its 50 neutral mark.

A closing price below Tuesday’s trough of 12,924 and the 50-day exponential moving average (EMA) could encourage more selling, though only a significant decline below 12,660 would put the market’s uptrend under speculation, shifting the medium-term picture from positive to neutral as well. Yet the positive slope in the 50-day EMA that increases distance above the 200-day EMA suggests that an outlook reversal may come later rather than sooner.

Clearing the 12,660 threshold, all attention will turn to the 12,451 resistance area, and the 200-day EMA that managed to curb downside corrections early in October.

Should the bulls beat the wall around 13,300, the next target would be the 13,400 level, a break of which could see a retest of the all-time high level of 13,596 registered in January 2018.

In brief, the GER30 stock index is likely to follow a sideways path in the short-term, with traders waiting for a breakout above 13,300 or below 12,924 to reconsider their positions. In the medium-term, the positive outlook is likely to stay intact as long as the price holds above 12,660.