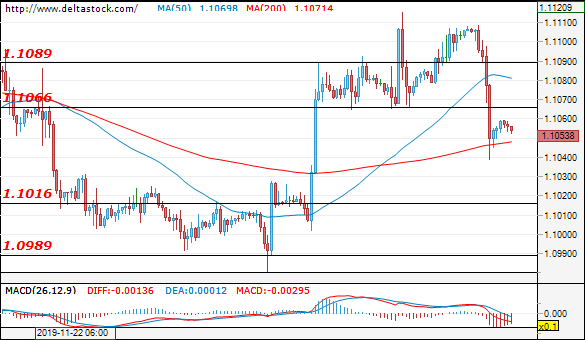

EUR/USD

Current level – 1.1053

After the surprisingly good data for the nonfarm payrolls change in the US last week, we witnessed a sharp appreciation of the US dollar against the euro. For the moment, the sentiment is rather negative, after the bears managed to regain their positions after they broke through the main support at 1.1066. The EUR/USD is currently headed for a test of the next support level at 1.1016. The main driving force for price action this week will be Fed’s interest rate decision on Wednesday (19:00 GMT), followed by the European Central Bank’s interest rate decision on Thursday (12:45 GMT).

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1060 | 1.1140 | 1.1020 | 1.0990 |

| 1.1090 | 1.1170 | 1.0990 | 1.0880 |

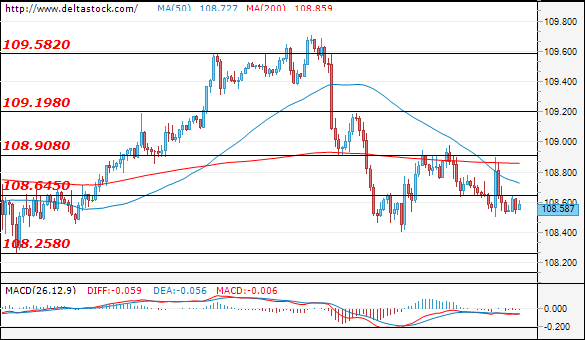

USD/JPY

Current level – 108.58

For the moment, the currency pair is consolidating around the support level at 108.60. Positive developments around the US-China trade talks should give a positive boost to the US dollar for a test of the resistance level at 108.90 and then 109.20. In negative direction the main support is at 108.25.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 108.65 | 109.20 | 108.25 | 107.05 |

| 108.90 | 109.60 | 107.85 | 106.60 |

GBP/USD

Current level – 1.3140

The sentiment is still positive, although the currency pair slowed its upward momentum, reaching the resistance zone at 1.3175. We may witness a correction before the expected rise of the price, with a major support at 1.3000. The main driving forces for the pound will be the UK general elections on Thursday.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.3170 | 1.3255 | 1.3000 | 1.2890 |

| 1.3214 | 1.3320 | 1.2960 | 1.2820 |