Key Highlights

- EUR/USD failed to gain strength above 1.1150 and declined below 1.1100.

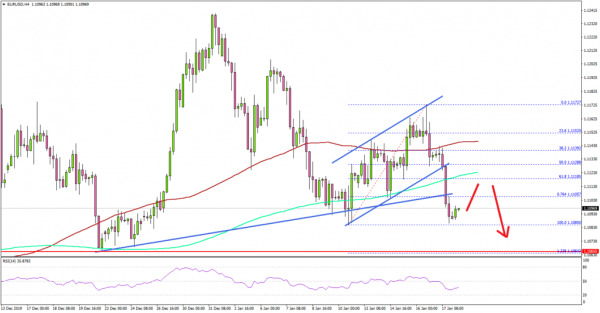

- There was a break below a crucial bullish trend line with support near 1.1105 on the 4-hours chart.

- The Euro Zone CPI increased 1.3% in Dec 2019 (YoY), similar to the market forecast.

- The German Producer Price Index could rise 0.1% in Dec 2019 (MoM).

EUR/USD Technical Analysis

This past week, EUR/USD tested the 1.1150-1.1170 resistance area and failed to continue higher. As a result, the Euro started a fresh decline and broke the 1.1120 support against the US Dollar.

Looking at the 4-hours chart, the pair broke many key supports near 1.1120 and 1.1100 to enter a bearish zone. Moreover, there was a break below a crucial bullish trend line with support near 1.1105.

The pair settled below the 1.1120 level and the 100 simple moving average (red, 4-hours). It tested the last swing low at 1.1085 and it remains at a risk of more losses.

The first support is near the 1.1065 level since it represents the 1.236 Fib extension level last major recovery from the 1.1085 low to 1.1172 high.

If the pair fails to stay above the 1.1065 support, it could continue to move down towards 1.1025 or 1.1000 in the coming sessions. On the upside, an initial resistance is near the 1.1120 level.

The main hurdle for EUR/USD is near the 1.1150 level and the 100 simple moving average (red, 4-hours). A convincing follow through above 1.1150 is needed for a strong upward move.

Fundamentally, the Euro Zone CPI for Dec 2019 was released by the Eurostat. The market was looking for sales to increase 1.3% in Dec 2019 compared with the same month a year ago.

The actual result was in line with the forecast, as the Euro Zone CPI increased 1.3%. Looking at the monthly change, the CPI increased 0.3%, similar to the last reading and up from the last -0.3%.

The report added:

In December, the highest contribution to the annual euro area inflation rate came from services (+0.80 percentage points, pp), followed by food, alcohol & tobacco (+0.38 pp), non-energy industrial goods (+0.12 pp) and energy (+0.02 pp).

Overall, EUR/USD could struggle to climb above 1.1150 and it could extend its decline. Looking at GBP/USD, the pair is likely to continue lower below 1.3000 if it stays below 1.3100.

Upcoming Economic Releases

- German Producer Price Index for Dec 2019 (MoM) – Forecast +0.1%, versus 0% previous.

- German Producer Price Index for Dec 2019 (YoY) – Forecast -0.6%, versus -0.7% previous.