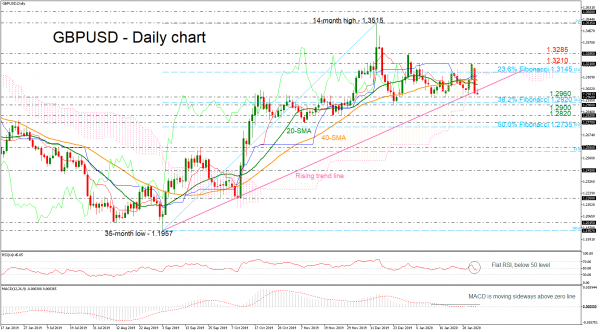

GBPUSD tumbled on Monday, falling back below the 1.3000 handle and the short-term moving averages (SMAs) in the daily timeframe. The price is flirting with the five-month ascending trendline, aiding in confining the price within a sideways move and dropping below the nearby low levels.

However, the technical indicators are signaling a lacking direction. The RSI is flattening marginally below the 50 level, while the MACD oscillator is moving sideways near its trigger and zero lines over the last three weeks. Moreover, the horizontal moving averages are implying a neutral trend in the short-term timeframe.

In case of a continuation of the strong sell-off further below the diagonal line, immediate support is coming from the 1.2960 level and the 38.2% Fibonacci retracement mark of the upward wave from 1.1957 to 1.3515 near 1.2920. Slightly below this level, the 1.2900 psychological region is coming into focus ahead of the 1.2820 barrier.

Alternatively, a return above the uptrend line may drive the pair until the 20- and 40-day SMAs currently at 1.3050 and 1.3090 respectively. Above these levels the 23.6% Fibo of 1.3145 and the Ichimoku cloud could be the next targets before the 1.3210 and 1.3285 resistances come into play.

Summarizing, GBPUSD is failing to show a clear picture in the very short-term, but a decisive close below 1.2900 could open the door for a bearish run.