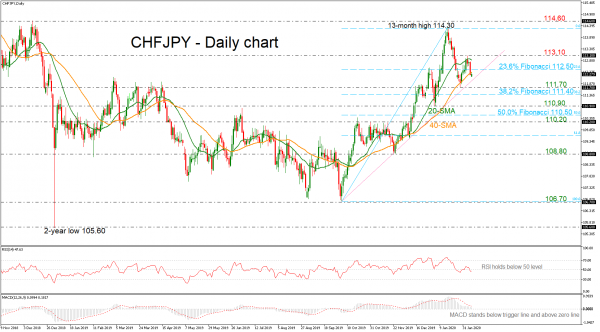

CHFJPY has declined considerably after the pull back on the 113.10 zone and the 20-day simple moving average (SMA). Currently, the price is capped by the 40-day SMA and is moving near the minor rising trend line drawn from October 4 with the technical indicators moving lower. The RSI is standing below the 50 level and the MACD slipped beneath the trigger line in the positive zone.

Immediate support is being provided by the ascending trend line above the 111.70 barrier. However, should prices dip lower than those levels, the next support would likely come from the 38.2% Fibonacci retracement level of the upward move from 106.70 to 114.30 near 111.40. A drop underneath would open the way for the barrier slightly below the 111.00 handle at 110.90, identified by the low on January 3.

In case of an upward attempt, CHFJPY would likely meet resistance at the 23.6% Fibonacci of 112.50 ahead of the 20-day SMA at 112.90. A break above this level could open the door for the 113.10 swing high, taken from the latest peak. With further advances, the pair could flirt with the 13-month top of 114.30 and the 114.60 resistance overhead, which if broken would help turn the short-term bias to a strongly bullish one.

Overall, the medium-term outlook is currently looking bullish with a possible rebound on the uptrend line.