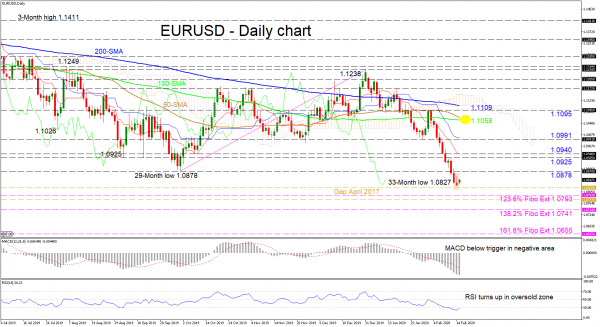

EURUSD appears to have slowed slightly – with the development of an inverted hammer pattern – ahead of the April 2017 gap of 1.0820 – 1.0777 following a descent, which deflected off the 50-day simple moving average (SMA) around 1.1095.

The short-term oscillators, although still negative, are showing a marginal increase in positive momentum. The MACD is deep in the negative region and below its red trigger line, though smoothing slightly, while the RSI has made a minor improvement in the oversold territory. That said, the nearing bearish cross of the 100-day SMA by the 50-day one and the distancing of the downward sloping Tenkan-sen from the blue Kijun-sen line, all suggest, that maybe the downward move may endure a while longer.

To the downside, immediate support could come from the April 2017 gap from 1.0820 to 1.0777, which also encapsulates the 1.0793 level, this being the 123.6% Fibonacci extension of the up leg from 1.0878 to 1.1238. A successful dive beneath this barrier could encounter the 138.2% Fibo extension of 1.0741 and if the bears persist, the 161.8% Fibo extension at 1.0655 may be next to draw traders’ attention.

Otherwise, if buying interest picks up, initial resistance could come from the 1.0878 level from October 2019 ahead of a limiting region from 1.0925 to 1.0940. Overrunning this, the 1.0991 inside swing low could deter the pair from testing the area of the upcoming bearish cross of the 50- and 100-day SMAs currently around 1.1058. Clearing this too, the 1.1095 high and the 200-day SMA at the Ichimoku cloud, may prove difficult to surpass.

Overall, in the very short-term, the market is strongly bearish if the pair remains below the 1.0878 low, while a move back above this level could turn it back to neutral.