The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.07848

Open: 1.08247

% chg. over the last day: +0.56

Day’s range: 1.08150 – 1.08424

52 wk range: 1.0879 – 1.1572

On Friday, the EUR/USD currency pair moved away from three-year lows. Quotes updated local highs. Financial market participants have begun to fix greenback positions partially. Investors are still concerned about the spread of coronavirus outside of China. At the moment, the local support and resistance levels are 1.08000 and 1.08300, respectively. A trading instrument has the potential for further correction. We expect important statistics from Germany. We recommend opening positions from key levels.

The Economic News Feed for 24.02.2020:

At 11:00 (GMT+2:00), German IFO business climate index will be published.

Indicators do not give accurate signals: 50 MA has crossed 100 MA.

The MACD histogram is in the positive zone, but below the signal line, which gives a weak signal to buy EUR/USD.

Stochastic Oscillator is in the oversold zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.08000, 1.07800

Resistance levels: 1.08300, 1.08650, 1.09000

If the price fixes above 1.08300, further correction of EUR/USD quotes is expected. Movement is tending to 1.08600-1.08900.

An alternative could be a decrease in the EUR/USD currency pair to 1.07800-1.07500.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.28796

Open: 1.29448

% chg. over the last day: +0.70

Day’s range: 1.29338 – 1.29543

52 wk range: 1.1959 – 1.3516

GBP/USD quotes have been growing. The trading instrument has updated local highs. Currently, the British pound is consolidating. The key support and resistance levels are 1.29300 and 1.29800, respectively. The technical pattern signals a further correction of the GBP/USD currency pair. We recommend opening positions from key levels.

The publication of important economic releases from the UK is not planned.

Indicators do not give accurate signals: the price has crossed 100 MA.

The MACD histogram is in the positive zone, but below the signal line, which gives a weak signal to buy GBP/USD.

Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which indicates the bullish sentiment.

Trading recommendations

Support levels: 1.29300, 1.29000, 1.28500

Resistance levels: 1.29800, 1.30150, 1.30600

If the price fixes above the resistance level of 1.29800, further growth of GBP/USD quotes is expected. Movement is tending to 1.30150-1.30500.

An alternative could be a decrease in the GBP/USD currency pair to 1.29000-1.28700.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.32587

Open: 1.32508

% chg. over the last day: -0.26

Day’s range: 1.32430 – 1.32839

52 wk range: 1.2949 – 1.3566

There is the bullish sentiment on the USD/CAD currency pair. The trading instrument has set new local highs. Loonie approached the resistance level of 1.32900. The 1.32600 mark is already a “mirror” support. USD/CAD quotes have the potential for further growth. We recommend paying attention to the dynamics of “black gold” prices. Positions should be opened from key levels.

The news feed on Canada’s economy is calm enough.

Indicators signal the power of buyers: the price has fixed above 50 MA and 100 MA.

The MACD histogram is in the positive zone and above the signal line, which gives a strong signal to buy USD/CAD.

Stochastic Oscillator is in the overbought zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.32600, 1.32400, 1.32150

Resistance levels: 1.32900, 1.33250

If the price fixes above 1.32900, further growth of USD/CAD quotes is expected. The movement is tending to 1.33100-1.33300.

An alternative could be a decrease in the USD/CAD currency pair to 1.32300-1.32000.

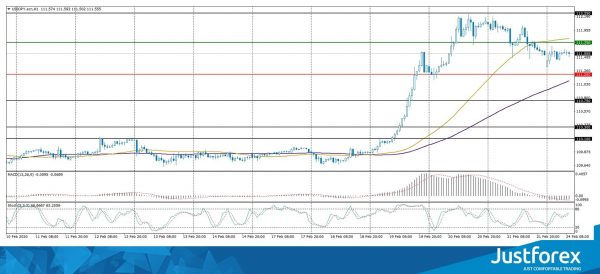

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 112.091

Open: 111.342

% chg. over the last day: -0.48

Day’s range: 111.317 – 111.682

52 wk range: 104.45 – 113.53

USD/JPY quotes have become stable after a sharp increase last week. Currently, the trading instrument is consolidating. There is no defined trend. The key support and resistance levels are 111.200 and 111.750, respectively. In the near future, a technical correction of the USD/JPY currency pair is not excluded. We recommend paying attention to the dynamics of the US government bonds yield. Positions should be opened from key levels.

Japan’s financial markets are closed due to the holiday.

Indicators do not give accurate signals: the price has fixed between 50 MA and 100 MA.

The MACD histogram is in the negative zone, which indicates the development of the correction movement.

Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which gives a signal to buy USD/JPY.

Trading recommendations

Support levels: 111.200, 110.750

Resistance levels: 111.750, 112.250, 112.500

If the price fixes below 111.200, USD/JPY quotes are expected to correct. Movement is tending to 110.800-110.500.

An alternative could be the growth of the USD/JPY currency pair to 112.200-112.500.