The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.12348

Open: 1.13372

% chg. over the last day: +0.93

Day’s range: 1.13260 – 1.13837

52 wk range: 1.0777 – 1.1494

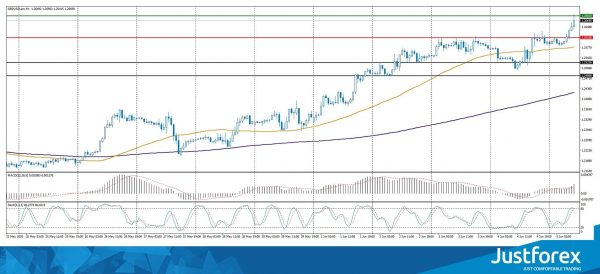

The EUR/USD currency pair continues to show a steady uptrend. Since the beginning of this week, quotes growth has exceeded 250 points. Investors assess the ECB meeting. The regulator has kept key interest rates unchanged. The Central Bank has increased the crisis bond-buying program by 600 billion euros instead of the expected 500 billion. Currently, EUR/USD quotes are consolidating in the range of 1.1315-1.1380. Investors have taken a wait-and-see attitude before today’s US labor market report for May. Experts forecast quite pessimistic labor statistics. We recommend paying attention to the difference between the actual and forecasted values. Positions should be opened from key levels.

The Economic News Feed for 2020.06.05:

At 15:30 (GMT+3:00), a report on the US labor market will be published.

Indicators signal the power of buyers: the price has fixed above 50 MA and 100 MA.

The MACD histogram is in the positive zone, indicating the bullish sentiment.

Stochastic Oscillator is near the overbought zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.1315, 1.1250, 1.1190

Resistance levels: 1.1380, 1.1450

If the price fixes above 1.1380, further growth of EUR/USD quotes is expected. The movement is tending to 1.1430-1.1450.

An alternative could be a decrease in the EUR/USD currency pair to 1.1260-1.1230.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.25710

Open: 1.25966

% chg. over the last day: +0.17

Day’s range: 1.25840 – 1.26903

52 wk range: 1.1466 – 1.3516

GBP/USD quotes show a pronounced uptrend. The British pound has approached the $1.27 mark. The 1.2610 level is already a “mirror” support. The demand for risky assets is still high. At the moment, financial market participants have taken a wait-and-see attitude before labor statistics in the US for May. We recommend opening positions from key levels.

The news feed on the UK economy is calm today.

Indicators signal the power of buyers: the price has fixed above 50 MA and 100 MA.

The MACD histogram is in the positive zone and above the signal line, which gives a strong signal to buy GBP/USD.

Stochastic Oscillator is near the overbought zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.2610, 1.2525, 1.2480

Resistance levels: 1.2685, 1.2750, 1.2800

If the price fixes above 1.2685, further growth of GBP/USD quotes is expected. The movement is tending to 1.2750-1.2780.

An alternative could be a decrease in the GBP/USD currency pair to 1.2560-1.2530.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.34964

Open: 1.34962

% chg. over the last day: -0.01

Day’s range: 1.34621 – 1.35126

52 wk range: 1.2949 – 1.4668

USD/CAD quotes continue to consolidate. There is no defined trend. At the moment, the local support and resistance levels are 1.3460 and 1.3520, respectively. We expect the release of reports on the labor market in the United States and Canada. We also recommend paying attention to the dynamics of “black gold” prices. Positions should be opened from key levels.

The News Feed on Canada’s Economy:

Data on the labor market of Canada at 15:30 (GMT+3:00);

Ivey PMI at 17:00 (GMT+3:00).

Indicators do not give accurate signals: the price has crossed 50 MA.

The MACD histogram has started declining, which indicates the development of bearish sentiment.

Stochastic Oscillator is near the oversold zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.3460, 1.3400

Resistance levels: 1.3520, 1.3585, 1.3675

If the price fixes below 1.3460, a further drop in USD/CAD quotes is expected. The movement is tending to the round level of 1.3400.

An alternative could be the growth of the USD/CAD currency pair to 1.3560-1.3600.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 108.869

Open: 109.147

% chg. over the last day: +0.22

Day’s range: 109.044 – 109.427

52 wk range: 101.19 – 112.41

Purchases still prevail on the USD/JPY currency pair. The trading instrument has updated local highs again. At the moment, USD/JPY quotes are testing the resistance level of 109.40. The 109.10 mark is already a “mirror” support. Further growth of the USD/JPY currency pair is possible. We recommend paying attention to the report on the US labor market. Positions should be opened from key levels.

The news feed on Japan’s economy is calm.

Indicators signal the power of buyers: the price has fixed above 50 MA and 100 MA.

The MACD histogram is in the positive zone, indicating the bullish sentiment.

Stochastic Oscillator is near the overbought zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 109.10, 108.85, 108.60

Resistance levels: 109.40, 110.00

If the price fixes above 109.40, further growth of the USD/JPY quotes is expected. The movement is tending to 110.00-110.20.

An alternative could be a decrease in the USD/JPY currency pair to 108.80-108.50.