Key Highlights

- USD/JPY started a fresh increase and surpassed the 107.00 resistance.

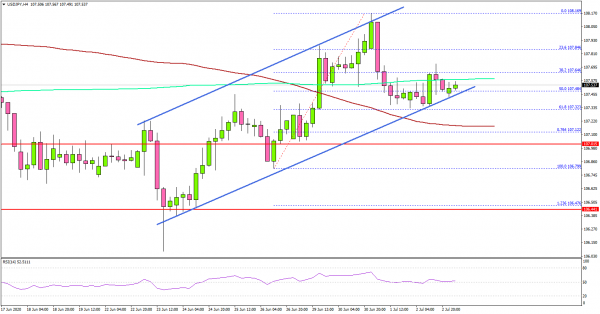

- A key rising channel is forming with support near 107.40 on the 4-hours chart.

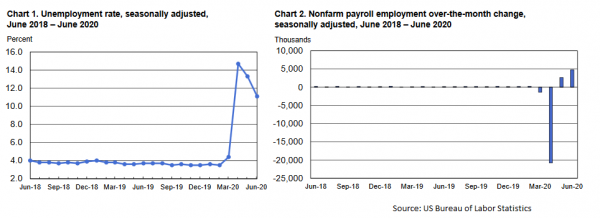

- The US nonfarm payrolls increased 4,800K in June 2020, more than the 3,000K forecast.

- The US Unemployment Rate improved from 13.3% to 11.1%.

USD/JPY Technical Analysis

After diving below the 106.50 support, the US Dollar found support at 106.20 and started a fresh increase against the Japanese Yen. USD/JPY surpassed the 107.00 resistance and it might continue to rise in the near term.

Looking at the 4-hours chart, the pair even gained bullish momentum above the 107.00 resistance and the 100 simple moving average (red, 4-hours). It even climbed above the 107.50 resistance and the 200 simple moving average (green, 4-hours).

Finally, it spiked above 108.00, traded as high as 108.16, and recently corrected lower. It broke the 50% Fib retracement level of the upward move from the 106.79 swing low to 108.16 high.

However, the pair is finding bids above the 107.40 level and the 100 SMA. There is also a key rising channel forming with support near 107.40 on the same chart. If the pair fails to stay above the 107.40 support, there is a risk of a larger decline below the 107.00 support.

The next major support is near the 106.45 level, followed by 106.20. On the upside, the pair could face hurdles near 107.80 and 108.00. A successful close above the 108.00 level could open the doors for a strong rally towards the 108.80 and 109.20 levels.

Fundamentally, the US nonfarm payrolls report for June 2020 was released by the US Bureau of Labor Statistics. The market was looking for an increase of 3,000K in jobs, more than the last 2,509K.

The actual result was well above the market forecast, as the total nonfarm payroll employment rose by 4,800K in June 2020. The last reading was also revised up from 2,509K to 2,699K.

The report added:

The unemployment rate declined by 2.2 percentage points to 11.1 percent in June, and the number of unemployed persons fell by 3.2 million to 17.8 million.

Overall, USD/JPY is likely to continue higher as long as it is above 107.40. Looking at EUR/USD, the pair broke the 1.1250 resistance, and GBP/USD recovered higher towards 1.2540.

Upcoming Economic Releases

- Germany’s Services PMI for June 2020 – Forecast 45.8, versus 45.8 previous.

- Euro Zone Services PMI for June 2020 – Forecast 47.3, versus 47.3 previous.

- UK Services PMI for June 2020 – Forecast 47.0, versus 47.0 previous.