The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.18333

Open: 1.18285

% chg. over the last day: -0.03

Day’s range: 1.18166 – 1.18498

52 wk range: 1.0637 – 1.1967

Since the beginning of this week, the greenback has shown ambiguous results against its main competitors. The EUR/USD currency pair is being traded in a flat. Financial market participants are focused on today’s speech by the Fed Chairman. Today, Jerome Powell will speak at the annual Jackson Hole symposium. During his speech, he will talk about the revision of the monetary policy by the Fed. Trading activity and volatility may increase significantly. At the moment, the key range is 1.1785-1.1845. We recommend opening positions from these marks.

The news feed on 2020.08.27:

Data on US GDP at 15:30 (GMT+3:00);

Initial jobless claims in the US at 15:30 (GMT+3:00);

Speech by the Fed Chairman at 16:10 (GMT+3:00);

Pending home sales in the US at 17:00 (GMT+3:00).

Indicators do not give accurate signals: the price has crossed the 50 MA and 100 MA.

The MACD histogram is near the 0 mark.

Stochastic Oscillator is in the neutral zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.1785, 1.1755

Resistance levels: 1.1845, 1.1885, 1.1920

If the price fixes above 1.1845, EUR/USD quotes are expected to grow. The movement is tending to 1.1885-1.1920.

An alternative may be a decline in the EUR/USD currency pair to 1.1755-1.1720.

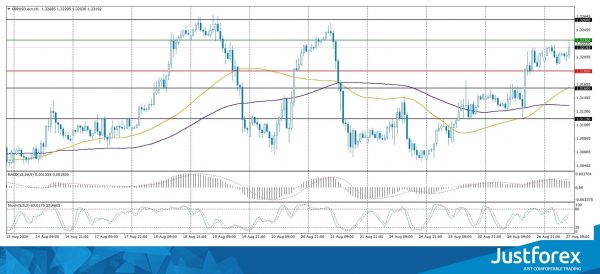

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.31429

Open: 1.31988

% chg. over the last day: +0.44

Day’s range: 1.31937 – 1.32295

52 wk range: 1.1409 – 1.3516

The bullish sentiment prevails on the GBP/USD currency pair. The British pound has reached key extremes. At the moment, GBP/USD quotes are consolidating. Local support and resistance levels are 1.3185 and 1.3230, respectively. Investors expect a speech by the Fed Chairman. Further growth of the trading instrument is possible. Positions should be opened from key levels.

The news feed on the UK economy is calm.

Indicators signal the power of buyers: the price has fixed above 50 MA and 100 MA.

The MACD histogram is in the positive zone, but below the signal line, which gives a weak signal to buy GBP/USD.

Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which indicates the bullish sentiment.

Trading recommendations

Support levels: 1.3185, 1.3160, 1.3115

Resistance levels: 1.3230, 1.3260

If the price fixes above 1.3230, GBP/USD quotes are expected to grow. The movement is tending to 1.3260-1.3300.

An alternative could be a decline in the GBP/USD currency pair to 1.3150-1.3120.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.31689

Open: 1.31413

% chg. over the last day: -0.22

Day’s range: 1.31361 – 1.31664

52 wk range: 1.2949 – 1.4669

The technical pattern on the USD/CAD currency pair is still ambiguous. The loonie is still being traded in a flat with a quite wide range. At the moment, the local support and resistance levels are 1.3135 and 1.3165, respectively. The trading instrument is tending to decline. We recommend paying attention to the news feed on the US economy. Positions should be opened from key levels.

Important economic releases from Canada are not planned to be published.

Indicators signal the power of sellers: the price has fixed below 50 MA and 100 MA.

The MACD histogram is in the negative zone, but above the signal line, which gives a weak signal to sell USD/CAD.

Stochastic Oscillator is in the neutral zone, the %K line is below the %D line, which indicates the bearish sentiment.

Trading recommendations

Support levels: 1.3135, 1.3100

Resistance levels: 1.3165, 1.3190, 1.3205

If the price fixes below 1.3135, USD/CAD sales should be considered. The movement is tending to 1.3100-1.3070.

An alternative could be the growth of the USD/CAD currency pair to 1.3190-1.3220.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 106.362

Open: 105.982

% chg. over the last day: -0.36

Day’s range: 105.803 – 106.076

52 wk range: 101.19 – 112.41

The USD/JPY currency pair has moved away from local highs. At the moment, the trading instrument is consolidating. Local support and resistance levels are 105.80 and 106.15, respectively. Financial market participants expect a speech by the Fed Chairman. We also recommend paying attention to the dynamics of US government bonds yield. Positions should be opened from key levels.

The publication of important economic releases from Japan is not planned.

Indicators do not give accurate signals: the price has crossed the 100 MA.

The MACD histogram is in the negative zone, but above the signal line, which gives a weak signal to sell USD/JPY.

Stochastic Oscillator is in the neutral zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 105.80, 105.45, 105.15

Resistance levels: 106.15, 106.40, 106.55

If the price fixes below 105.80, a further drop in USD/JPY quotes is expected. The movement is tending to 105.50-105.20.

An alternative could be the growth of the USD/JPY currency pair to 106.50-106.80.