Key Highlights

- USD/JPY started a fresh increase after retesting the 105.20 support area.

- A key bearish trend line is in place with resistance near 106.70 on the 4-hours chart.

- The US ISM Services PMI declined from 58.1 to 56.9 in August 2020.

- The US nonfarm payrolls could increase 1,400K in August 2020, less than the last 1,763K.

USD/JPY Technical Analysis

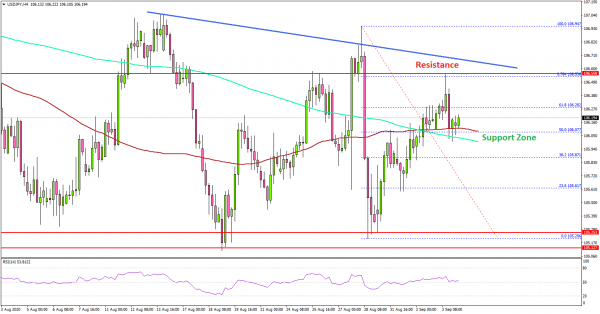

This past week, the US Dollar revisited the main 105.20 support area against the Japanese Yen. USD/JPY remained well bid near 105.20 and started a fresh increase in the past three days.

Looking at the 4-hours chart, the pair climbed higher nicely above the 105.80 resistance and the 100 simple moving average (red, 4-hours). There was a break above the 50% Fib retracement level of the downward move from the 106.94 high to 105.20 low.

However, the pair is now facing a strong resistance near the 106.70 inflection zone. There is also a key bearish trend line in place with resistance near 106.70 on the same chart. The 76.4% Fib retracement level of the downward move from the 106.94 high to 105.20 low is near the 106.60 level.

Therefore, a successful close above the 106.60 and 106.70 resistance levels is must for upside continuation. The next key resistance is near the 107.00 area.

Conversely, the pair might start a fresh decline below the 106.00 support and the 100 simple moving average (red, 4-hours). In the stated case, the pair may perhaps revisit the 105.20 support.

Fundamentally, the US ISM Services PMI for August 2020 was released yesterday by the Institute for Supply Management (ISM). The market was looking for a decline from 58.1 to 57.0.

The actual result was lower than the forecast, as the US ISM Services PMI (formerly the Non-Manufacturing NMI®) registered 56.9 percent, 1.2 percentage points lower than the July reading of 58.1 percent.

Overall, USD/JPY might struggle to clear the key 106.70 resistance zone. Looking at EUR/USD, the pair tested the 1.1800 support zone, and GBP/USD found strong bids near 1.3250.

Upcoming Economic Releases

- US nonfarm payrolls August 2020 – Forecast 1,400K, versus 1,763K previous.

- US Unemployment Rate August 2020 – Forecast 9.8%, versus 10.2% previous.

- Canada’s employment Change August 2020 – Forecast 275K, versus 418.5K previous.

- Canada’s Unemployment Rate August 2020 – Forecast 10.1%, versus 10.9% previous.