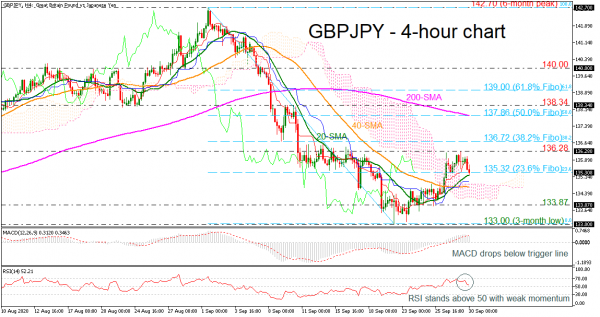

GBPJPY has paused the downside movement at the 23.6% Fibonacci retracement level of the down leg from 142.70 to 133.00 at 135.32 in the very short-term. The MACD oscillator dipped below its trigger line in the positive zone, while the RSI is slipping above the 50 level. However, the 20- and 40-period simple moving averages (SMAs) completed a bullish crossover, acting as strong support for the bulls.

A rebound on the 23.6% Fibo of 135.32 could take the price until the 136.28 resistance ahead of the 38.2% Fibonacci of 136.72. Moving higher, the 200-period SMA, which overlaps with the 50.0% Fibo could be a crucial barrier for traders.

On the other hand, a successful fall beneath the 20-period SMA could open the door for the upper surface of the Ichimoku cloud at 134.80 and the 40-period SMA. If the price fails to hold above these levels, the 133.87 barrier is the next target before heading south to the three-month low of 133.00.

Concluding, GBPJPY is lacking direction in the short-term timeframe after the bounce off the 133.00 psychological mark. A jump above the 200-period SMA could shift the neutral outlook to bullish. Alternatively, a tumble beneath 133.00 could switch the bias back to bearish.