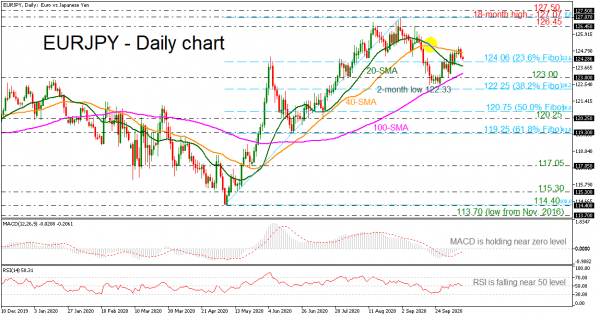

EURJPY has come under renewed selling interest, falling back below the 40-day simple moving average (SMA) and near the 23.6% Fibonacci retracement level of the up leg from 114.40 to 127.07 at 124.06.

In technical indicators, the MACD is gaining some ground above its trigger line, but it is still standing marginally below the zero level. The RSI indicator is pointing down in the positive territory, suggesting a downside pullback in the price.

However, if the price remains above the 23.6% Fibonacci, it could move towards the 126.45 barrier and the 18-month peak of 127.07. Above these levels, the 127.50 barrier could come next under the spotlight, taken from the high on February 2019.

Alternatively, more decreases could open the door for the 123.00 psychological level, but the price needs first to overcome the 20-day SMA at 123.80. Lower, the pair could meet the two-month low of 122.33 and the 38.2% Fibonacci at 122.25 before moving towards the 50.0% Fibonacci of 120.75.

Overall, EURJPY has been in a minor downside correction over the last six weeks. In the medium-term picture, a jump above the 18-month peak of 127.07 could shift the outlook back to bullish.