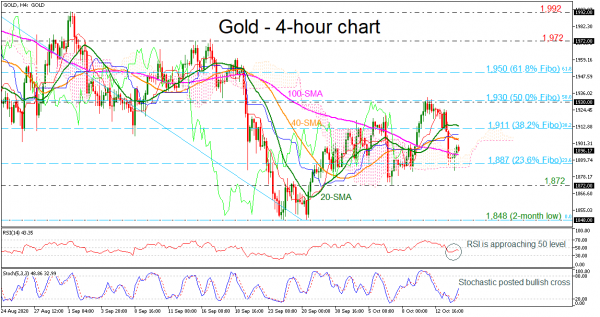

Gold prices bounced off the 23.6% Fibonacci retracement level of the down leg from 2,015 to 1,848 at 1,887, moving above the 100-period simple moving average (SMA). The technical indicators are endorsing the upside movement of the last couple of sessions. The RSI is standing near the neutral level of 50, while the stochastic is moving higher after the bullish cross within the %K and %D lines.

An extension to the upside could take the precious metal until the 40-period SMA at 1,904 before touching the 38.2% Fibonacci of 1,911. Marginally above this level the 20-period SMA would come at 1,914 ahead of the 50.0% Fibonacci of 1.930.

Alternatively, a drop below the 23.6% Fibonacci of 1,887 could move the market towards the 1,872 support and then at the two-month low of 1,848, achieved on September 28.

Overall, gold prices are recouping some losses that were posted in the preceding days, remaining in a somewhat positive bias in the very short-term.