Key Highlights

- EUR/USD started a fresh decline after it faced resistance near 1.1830.

- It traded below a major bullish trend line with support at 1.1800 on the 4-hours chart.

- GBP/USD failed to stay above 1.3000 and declined sharply.

- Crude oil price is still struggling to gain momentum above $41.50.

EUR/USD Technical Analysis

After a steady increase, the Euro faced a strong resistance near 1.1830 against the US Dollar. As a result, EUR/USD reacted to the downside and traded below many important supports.

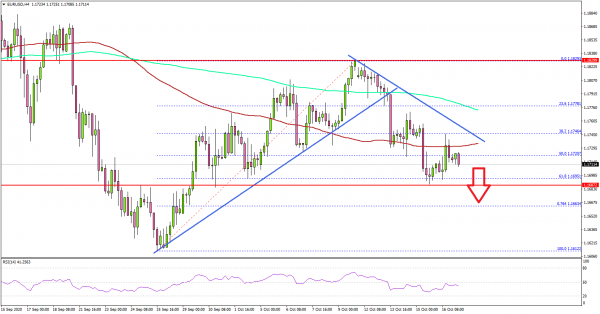

Looking at the 4-hours chart, the pair topped at 1.1829 before it started a fresh decline. There was a break below a major bullish trend line with support at 1.1800. The pair even settled below the 1.1750 support, the 200 simple moving average (green, 4-hours), and the 100 simple moving average (red, 4-hours).

There was a break below the 50% Fib retracement level of the main upward move from the 1.1612 low to 1.1829 high. The pair is now holding a crucial support near the 1.1685 level (a breakout zone).

The 61.8% Fib retracement level of the main upward move from the 1.1612 low to 1.1829 high is also providing support. If there is a clear break below the 1.1685 support, the pair could continue to move down towards the 1.1620 support.

On the upside, the bulls are facing a strong resistance near the 1.1750 level and a connecting bearish trend line on the same chart. A successful close above the 1.1750 level could increase the chances of a push above 1.1800 and 1.1820.

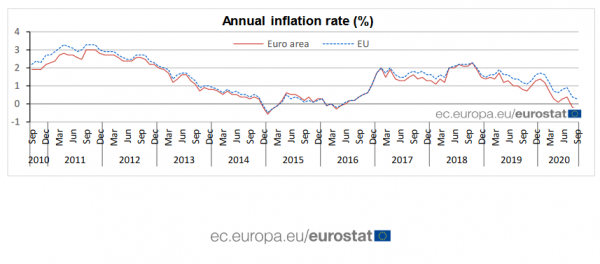

Fundamentally, the Euro Zone CPI for Sep 2020 was released this past Friday by the Eurostat. The market was looking for a decline of 0.3% in the CPI compared with the same month a year ago.

The actual result was in line with the forecast, as the Euro Zone CPI decrease 0.3% (YoY). Looking at the monthly change, there was a rise of 0.1% in the CPI, up from the last -0.4%.

The report added:

The lowest annual rates were registered in Greece (-2.3%), Cyprus (-1.9%) and Estonia (-1.3%). The highest annual rates were recorded in Poland (3.8%), Hungary (3.4%) and Czechia (3.3%).

Overall, EUR/USD is likely to continue lower if it struggles to clear the 1.1750 resistance. Looking at GBP/USD, there was a sharp bearish reaction after the pair faced a strong selling interest above 1.3050.

Upcoming Economic Releases

- Fed’s Chair Powell speech.

- ECB’s President Lagarde speech.