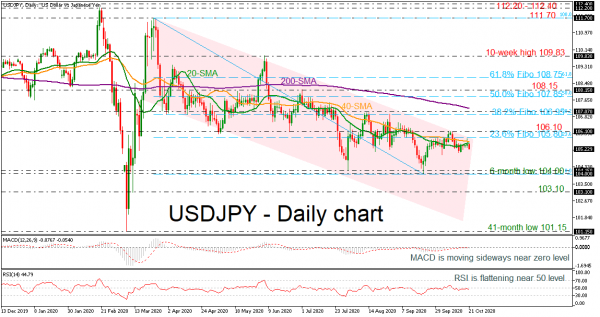

USDJPY has been making lower highs and lower lows since the end of March when it touched the 111.70 resistance level. The technical indicators, though, continue to send neutral signals, suggesting that the softness in the market is not over yet in the very short-term timeframe.

The RSI has flattened near the neutral threshold of 50, indicating that the market could weaken a little bit until the pair falls further in the descending channel. The MACD oscillator is still heading sideways marginally below the zero level and the trigger line, while the 20- and 40-day simple moving averages (SMAs) are holding above the current price action.

Should prices decline, support could be found around 104.00-104.15, which encapsulates the six-month low. Then in case of a drop below that level and the falling channel, the pair could meet the 103.10 barrier before the focus shifts to the 41-month bottom of 101.15.

In conclusion, USDJPY has been developing in a declining channel in the medium-term and only a significant climb above the 200-day SMA around 107.20 may change this outlook.